https://www.thesudburystar.com/

Construction of a road to the mine site needs to start now

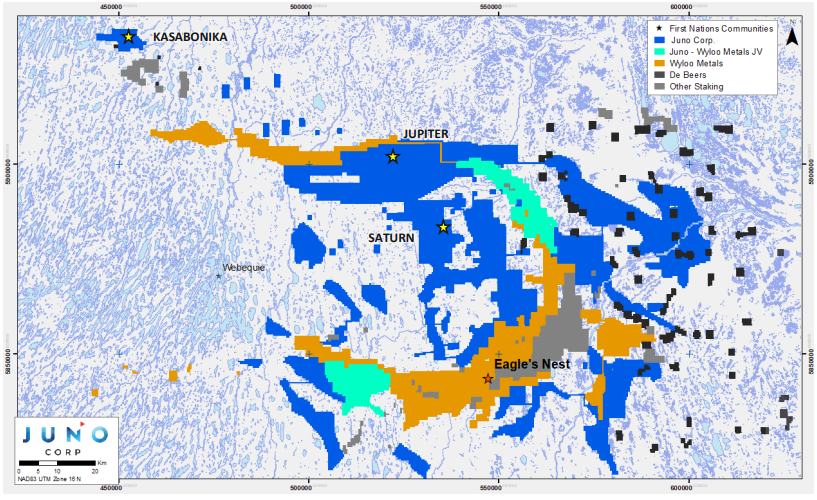

Without a doubt, the Ring of Fire camp and its many strategic minerals that include nickel, copper, platinum group metals, chromite and titanium – just to mention a few as explorers have just scratched the proverbial surface – is the most important mining discovery in Canadian history. It may even exceed the legendary Sudbury Basin someday.

Discovered in 2007, the region is located approximately 450 km northeast of Thunder Bay in the isolated and vast peatlands of Hudson Bay, which itself is roughly the size of Norway but with only about 10,000 people. Contrary to fanatical ENGOs, sustainable mineral development and exploration practices will have minimal impact on the environment and provide the critical minerals needed to stop global warming.