Northern Ontario Being Strangled

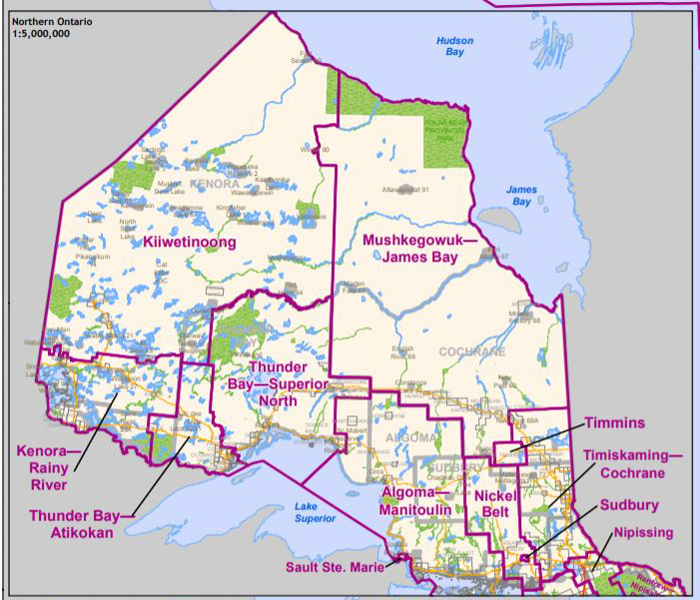

On June 7th, the people of Ontario will be going to the polls in one of the most pivotal elections in the province’s history. While Northern Ontario – north of the French and Mattawa Rivers, as I have never recognized the Parry Sound and Muskoka ridings as being part of the North – encompasses roughly 90 per cent of the province’s land mass, its population has been steadily declining to slightly over five per cent of Ontario’s total.

Unfortunately, our impact on provincial policies is almost negligible.

A buck a beer, cheaper gas, tax breaks combined with unaffordable infrastructure and social commitments, twinning the trans-Canada in Northern Ontario, buying back Hydro One, and jumping on a bulldozer to start building the road into the Ring of Fire are part of a bevy of mostly worthy but unsustainable promises Conservative Doug Ford, Liberal Kathleen Wynne and NDP Andrea Horwath have made.

However, I seldom hear any actual policy initiatives to grow the economy and create wealth so we can afford all these election initiatives and perhaps, just perhaps put a little money on our provincial debt which has more than doubled during the past 15 years under the McGuinty/Wynne Liberal era from about $138 billion in 2003/04 to $325 billion currently and growing. By the way, this is the largest sub-national debt in the world and twice as large as California which has a population of almost 40 million. We are paying roughly $1 billion a month to service that debt. That will surely rise when interest rates, which are at historic lows, eventually start going up!

Read more