https://www.northernontariobusiness.com/

Wallbridge eyes cross-border joint venture opportunity with Detour East option

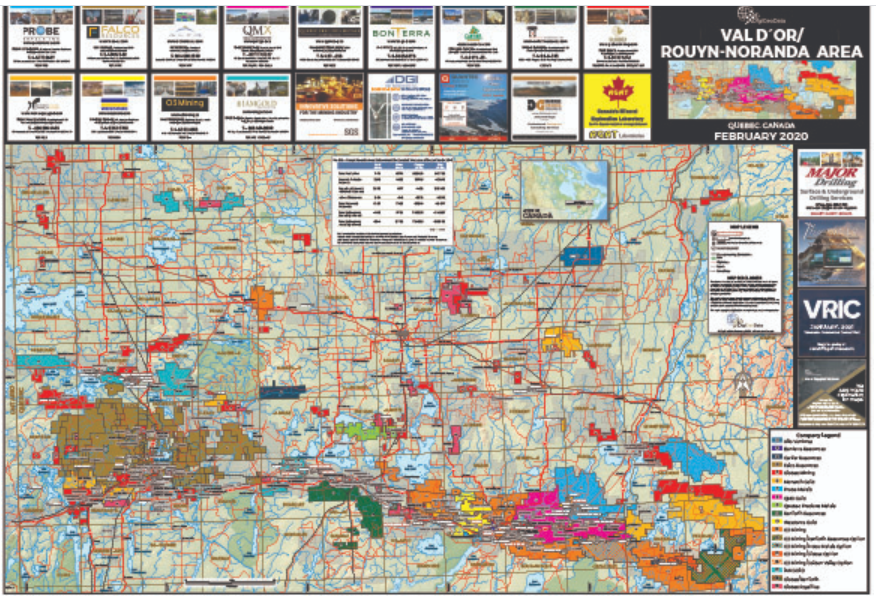

Sudbury’s Wallbridge Mining has inked a term sheet to do a joint venture with Kirkland Lake Gold of its Detour East gold property in northwestern Quebec.

Under the agreement, Kirkland Lake Gold can earn a 75 per cent interest in Detour East by spending a total of $35 million on exploration at the property.

Detour East is an early exploration stage property, 11 kilometres east of Kirkland Lake Gold’s Detour Lake gold mine in northeastern Ontario.