Peter Cashin is President & CEO of Imperial Mining Group and Phil Chataigneau the company’s Strategic Marketing Analyst.

Scandium has long been recognized as a grain‐refiner and hardener of aluminum alloys, however research and development completed to date in order to expand the use of this high-technology metal has been limited because global supply has been severely constrained. The limited availability of scandium in the commercial market, estimated at 35 metric tonnes per year, and the lack of an assured source of supply to provide material for new technologies and applications have limited its market growth.

Critical applications, although intriguing from a performance and capabilities enhancement standpoint, have been limited or ignored due to the lack of a reliable source of supply, high current cost, no scandium presence in the US Defense Stockpile and a 100% import reliance on China and Russia.

A new and reliable source of supply could enable the realization of the substantial benefits of scandium-aluminum alloy in aerospace and automotive lightweighting, military platform development and in fuel cell production. Easy fabrication of parts with a hardness approaching that of titanium, the superplastic nature of such alloys and improved weldability for aluminum structures incorporating the alloy are all beneficial attributes of this next-generation material.

Rio Tinto recently announced that they developed a new process to extract the critical metal scandium from by-products generated at its RTFT metallurgical operation in Sorel-Tracy, Quebec, a facility that produces titanium dioxide from ilmenite mined at the Lac Tio open-pit mine near Havre-Saint-Pierre. Developed by researchers at the Rio Tinto Fer et Titane (RTFT) Research & Development Centre, the company has been producing scandium oxide that meets market specifications since the second half of 2019 as part of a pilot project.

“This breakthrough on scandium is a great example of how we are looking at our operations across the world with fresh eyes to see how we can extract value from by-product streams,” Rio Tinto CEO Jean-Sébastien Jacques said in a press release. “This exciting breakthrough in processing technology leverages our existing mining operation to provide what can be a scalable, high-quality and low-cost source of scandium oxide to markets and manufacturers.”

The announcement is also a critical validation that a major mining player recognizes that scandium-aluminum alloys have significant market potential and, with the continued availability of sustainable sources of scandium supply, will likely see incremental growth where a strong, lightweight, heat and corrosion resistant material is required by manufacturers.

So why is Scandium important?

It is needed for high-technology applications of the 21st century, downstream supply chain contractors and, most importantly, for the integral Aluminum industry in Quebec. By using the abundantly available hydroelectricity, the Aluminum industry in Quebec has built itself into a powerhouse.

This industry generates $8.3B in primary Aluminum exports per year with 81% of it sent to the United States. This accounts for approximately 90% of all Canadian production involving 8,700 direct jobs, supporting 10,000 retirees and contributing to 17,000 processing jobs, 4,000 for equipment supply and 20,000 indirect support jobs. (Source: Aluminum Association of Canada, MESI Quebec and NR Canada)

The past few months have highlighted the critical interdependence of modern supply chains and more importantly the families of those who work in these industries. Scandium will help Canada, and Quebec industry in particular, to remain competitive in these extraordinary times.

What about the end market? Let us explore one of the key application areas in detail:

Aerospace Sector

While all of the disruptions caused by Covid19 have yet to be fully realized, one trend is emerging clearly – and that is the worldwide re-fleeting movement to replace older, less fuel efficient aircraft with newer models.(See Boeing and Airbus sources.)

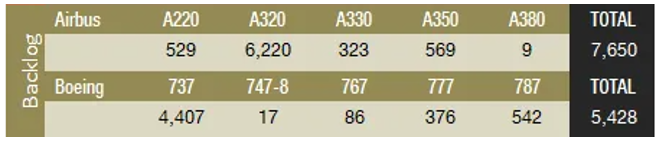

Surviving airlines must be flexible and even more cost conscious going forward. The same market forces that brought forward Geared Turbo Fan Engines are now driving the lightweighting and performance enhancement that Scandium, as part of the aluminum alloy, is ideally suited for. Let us look at the current backlog of aircraft on order:

Source Defence and Security Monitor, March 2020

The total number of aircraft on order represents 52% of the current world fleet of approximately 25,000 aircraft. According to Boeing’s latest quarterly report, their current order book totals $352B USD in business and represents 42% of Boeing’s yearly business. While not directly specified, Airbus’ orders are equally significant and the commercial aircraft division accounts for 77% of Airbus’ combined revenue. Both companies have significant Space and Defence segments, which would demand the performance of Scandium and could absorb a higher price point for input of the commodity.

The other upcoming markets for Scandium, in fuel cells or in powder form for additive manufacturing (Laser Melt 3D metal printing of components), are equally significant.

In summary, this is a pivotal moment for the Quebec aluminum industry and the families that rely on that industry. We have a ‘made in Canada’ solution that will not only ensure a vital industry stays competitive but that it can thrive and grow in this new environment.

The Rio Tinto project is the first important step in the creation of this new value chain. Who will be in line for the next important development in scandium?

ABOUT IMPERIAL MINING GROUP LTD. AND THE DEVELOPMENT OF A SCANDIUM SUPPLY CHAIN

Imperial Mining Group Ltd., based in Montreal, is a public, Canadian‐listed (TSX‐V: IPG) mineral resource development company focused on Technology Metals. Exploration on Imperial’s wholly‐owned Crater Lake Project between 2009 and 2014 has identified an important primary scandium and rare earth mineral resource in northeastern Quebec. Scandium mineralization is hosted in a large (six km diameter) alkali igneous intrusive complex, a primary source of all known technology metal deposits.

The high grades of scandium, large tonnages and amenability to recovery using conventional metallurgy defined on the project to date will allow Imperial to be a disruptive force in the market by being the lowest-cost producer for the commodity.

Imperial’s intent is to offer scandium at a lower price point that its competitors, enabling broader consumption of scandium to western alloys markets and assuring consumers of a long‐term, stable and sustainable supply of scandium.