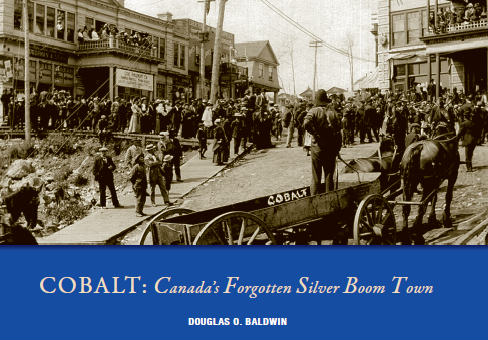

Douglas Baldwin is a retired history professor from Acadia University, Nova Scotia. This piece has been adapted from his new book, Cobalt: Canada’s Forgotten Silver Boom Town.

To order the book, click here: http://wmpub.ca/8094-SilverBoom.html

Speaking to the Empire Cub in Toronto in 1909, Rev. Canon Tucker told the story of a widely-travelled American who was asked where Toronto was. He thought for a moment, scratched his head and said, “Oh, yes, that is the place where you change cars for Cobalt.”

Although the value of the silver discovered in Cobalt far surpassed the riches uncovered during the Klondike rush only two decades earlier, few people today know of Cobalt’s history, or even of its existence.

Concentrated in an area less than thirteen square kilometres, about 400 kilometres north-east of Toronto near the Quebec border, Cobalt mines became the fourth-largest silver producer ever discovered.

When production peaked in 1911, Cobalt was providing roughly one-eighth of the world’s silver. During the First World War, the British government considered Canada’s silver supply so important to the war effort that it convinced Canadian Prime Minister Robert Borden to use his influence to prevent a planned strike in the Cobalt mining camp.