The Thunder Bay Chronicle-Journal is the daily newspaper of Northwestern Ontario. This opinion piece was originally published on March 15, 2011.

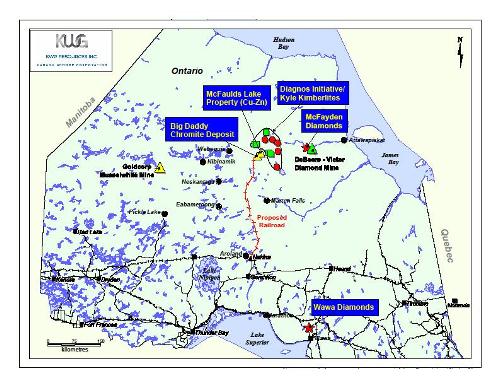

MAYOR Keith Hobbs is trying hard to position Thunder Bay as the logical location to process chromite from the giant Ring of Fire mineral deposit far to the north. In competition with officials from other Northern Ontario communities, Hobbs has made a good case.

Thunder Bay has the services, the manpower and expertise, the transportation and the electrical energy needed for a project of this size. And sizable it will be, requiring enough electricity to power a community of 300,000 people. It will be the largest single user of power in the province, which puts enormous pressure on the provincial government to provide what Cliffs Natural Resources, the main Ring of Fire developer, refers to as “a key input. The availability of a large, reliable, long-term and cost-competitive supply of electricity is a key consideration in siting the ferrochrome production facility.”

Cliffs identifies Timmins, Sudbury and Thunder Bay as potential locations, though it has gone so far as to use Sudbury as its base case model for planning purposes because it is already an important mineral processing centre. Hobbs has gone to some lengths to ensure Thunder Bay remains fully in Cliffs’ consideration and he’s got an Ontario Power Generation plant as one ace along with a Seaway port that Sudbury does not have.