Stan Sudol is a Toronto-based communications consultant who writes extensively about the mining industry. stan.sudol@republicofmining.com

For an extensive list of articles on this mineral discovery, please go to: Ontario’s Ring of Fire Mineral Discovery

“In the next 25 years, demand for metals could meet or exceed what we have used

since the beginning of the industrial revolution. By way of illustration, China needs to

build three cities larger than Sydney or Toronto every year until 2030 to accommodate

rural to urban growth. This equates to the largest migration of population from rural to

urban living in the history of mankind.” (John McGagh, Rio Tinto – Head of Innovation)

Mining Watch Reputation

Mining Watch was established in 1999 in response to the actions of Canadian exploration companies operating in Latin America and other jurisdictions in the developing world.

As stated on their website, “MiningWatch Canada … addresses the urgent need for a co-ordinated public interest response to the threats to public health, water and air quality, fish and wildlife habitat and community interests posed by irresponsible mineral policies and practices in Canada and around the world.”

In contrast to many in the mining sector I find a few of Mining Watch’s criticism’s legitimate and they have worked cooperatively with the industry in Ontario. In 2008, Mining Watch in conjunction with the Ontario Mining Association supported the amendment of the Ontario Mining Act that enabled companies to voluntarly rehabilitation mine sites even thought they had no legal requirments to do so.

Recently, Mining Watch has issued a report titled, “Economic analysis of the Ring of Fire chromite mining play”. It was written by former Sudbury resident and well-known social activist Joan Kuyek. While the report covers a wide range of topics, I would like to focus on some important issues that have been downplayed or omitted, primarily the current state of mining, geo-politics and a history of enormous wealth creation from the mineral sector due to government infrastructure support.

The Mining Watch report gives the impression that there is more than enough chromite currently being produced and that the economics of the Ring of Fire project is not sound, especially in reference to the 2007/08 financial downturn.

Commodity Super Cycle Back

Well, the commodity super cycle is back and with a vengeance! China, India, Brazil, Indonesia and many other developing economies are continuing their rapid pace of industrialization and urbanization. In 2010, China overtook Japan to become the world’s second largest economy and surpassed the United States to become the biggest producer of cars.

At the annual economics conference in Davos, Switzerland, held last January – where the most respected world leaders in politics, economics and academia gather – the consensus was one of enormous global prosperity predicting that, “For only the third time since the Industrial Revolution, the world may be entering a long-term growth cycle that will lift all economies simultaneously…”

In December, 2010, during the Toronto presentation of Rio Tinto’s $10 million donation to Sudbury’s Centre for Excellence in Mining (CEMI), John McGagh, Head of Innovation, at Rio Tinto said, “In the next 25 years, demand for metals could meet or exceed what we have used since the beginning of the industrial revolution. By way of illustration, China needs to build three cities larger than Sydney or Toronto every year until 2030 to accommodate rural to urban growth, this equates to the largest migration of population from rural to urban living in the history of mankind.”

As the developing world’s middle class populations explode, the demand for modern infrastructure – transportation systems, clean water, electricity, indoor plumbing – can only be built with the minerals we dig out of the ground in an environmentally sustainable manner.

Although the Mining Watch report gives an accurate description of chromite and the major producing countries, it fails to mention the strategic nature of the metal and the enormous political risk of the key suppliers. Chromite helps make steel harder and more corrosion resistant. It is a vital ingredient in a wide variety of stainless and heat resistant steels as well as many super alloys that have strategic military uses including the manufacturing of jet engines. Krupp, the German armaments manufacturer, started using chromium in its proprietary armour plating as early as 1893. There is no substitute for its unique attributes.

The United States includes the metal in its National Defense Stockpile (NDS). The NDS was established in 1939 “to provide a supply of strategic and critical materials in order to reduce the possibility of ‘a dangerous and costly dependence by the United States upon foreign sources for supplies of such materials in times of national emergency.’”

Political Uncertainty in Major Chromite Suppliers

According to the U.S. Geological Survey, the three largest producers of chromite ore are South Africa, Kazakhstan and India. It estimates that about 95% of the world’s current chromium resources are geographically concentrated in Southern Africa and Kazakhastan.

There are major issues in South Africa over power shortages, – ferrochrome smelters require large amounts of cheap energy – repeated calls for the nationalization of the mining industry by the militant youth wing of the leading political party, the African National Congress (ANZ), and black empowerment programs. Furthermore, China is becoming a major competitor for mineral resources across all of Africa and the large unequal distribution of wealth in South Africa, combined with a youth demographic similar to Tunisia, Egypt and Libya may be causing the industrial consumers of chromite significant concern.

Kazakhstan, a former part of the Union of Soviet Socialist Republic (U.S.S.R), is not known for its political stability and transparency. According to the well-respected Fraser Institute Survey of Mining Companies, (2010 Mid-Year Update) Kazakhstan was third from the bottom of the Policy Potential Index. While India is politically dependable, repeated calls to limit chromite exports due to that country’s rapidly growing economy are being heard. There is no chromite production in North America.

The Ring of Fire high-grade chromite deposits that Cliffs Natural Resources Inc. owns will use open pit mining methods in its early days versus the underground mines in South Africa which will give the company and very good cost advantage.

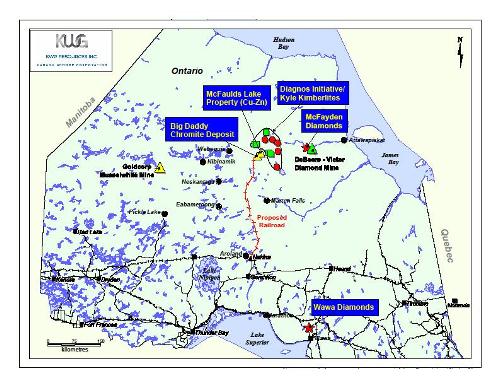

But, without some form of transportation infrastructure, the enormous potential of the entire Ring of Fire mining camp is questionable.

Railroad Versus Road

In a recent news conference, Cliffs Natural Resources Inc. seemed to favour the construction of a road over a rail line into the mining camp as a priority. While the building costs of a road or railroad are not that far apart, it is the maintenance and operating expenses which may dictate the economic efficiency of one mode of transport over the other. In that report, Cliffs estimates they will need between 50 to 100 trucks, each capable of transporting 70 tons. An average railcar holds about 100 tons which would require 35 to 70 units. A railway car which may cost $100,000 will last for at least 40 or 50 years versus a truck that costs roughly $250,000 and needs to be replaced every three or at most five years.

How much fuel will 50 – 100 trucks use compared to two or three diesel engines for the railcars? The impact on the environment will be much higher using 50 – 100 exhaust spewing trucks versus two or three diesel engines. You definitely need 50 – 100 employees for those trucks as opposed to two individuals for a standard train, an engineer and conductor. Most evidence indicates that when you are transporting bulk commodity products, the most economic, cost-effective way is by rail.

The Mining Watch report highlights the need for publicly funded infrastructure stating, “All companies have been demanding enormous government interventions to assist Ring of Fire development….”

Considering that the chromite mines by themselves will be a multi-generational operation providing employment opportunities and business ventures for the surrounding First Nations communities and the potential of other mineral discoveries that could include nickel, copper, zinc, platinum, palladium, vanadium and titanium, there is a solid economic case for government investment. The Ring of Fire has been compared to both the Sudbury Basin and the Abitibi Greenstone belt which includes Timmin, Kirkland Lake, Noranda and Val d’Or.

History of Government Support for Railroads

Northern Ontario’s history has many examples of resource development being made possible by government subsidization of railroad building. It was the federal government who paid for the construction of the Canadian Pacific Railroad that led to the discovery of the Sudbury nickel mines. Trillions of dollars worth of economic development over the past 128 years and predictions of another century of mining in the Sudbury Basin confirms that original investment worked out very well.

At the turn of the last century, the province of Ontario wanted to open up the isolated but fertile clay-belt soils of the Temiskaming region in the northeastern. Construction of the Temiskaming and Northern Ontario Railway began in 1903. At a site 103 miles north of North Bay, lumber contractors working on the railroad made the initial discovery that heralded the Cobalt silver boom. The silver mines, which made headlines around the world, finally ran out by the 1990s but this globally significant discovery yielded a phenomenal 460-million ounces of the precious metal.

Cobalt has often been called “the cradle of Canada’s mining industry.” It trained the prospecting and mining capabilities of Canadians provided enormous capital financing and set the stage for many other important discoveries in the region as the railroad progressed northward. The Sudbury ores were costly to mine and technically complicated to refine, that it was largely American capital and knowledge that developed them.

In 1909, 100 kilometres north of Cobalt, near Porcupine Lake, gold was discovered. The Porcupine Gold Rush was a transformative event in Canadian history, with three gold mines discovered by separate prospecting parties a few miles from each other. These rich discoveries produced the legendary Hollinger, MacIntryre and Dome Mines, led to the development of one of Canada’s premier mining camps, and the founding of the city of Timmins.

The Timmins discovery drew prospectors from around the world that led to the discovery of gold at Kirkland Lake in 1911. Prospectors crossed the Ontario/Quebec border where an enormous copper/gold deposit was discovered1923, and global mining company created, Noranada. More gold was found at Val d’Or in 1923.

The last official gold rush in North America occurred when gold was discovered in 1925 a few hundred feet from the shores of Red Lake, an isolated spot 110 miles northwest of Sioux Lookout, by prospectors from the Cobalt camp.

Over the past century, the Porcupine Camp has produced 72-million ounces and counting, once again booming Kirkland Lake had produced 38-million ounces to date and Red Lake, also prosperous, has produced 26-million up to 2006. By comparison, the Klondike produced only 12.5 million ounces during its decade-long short-lived rush.

Hardrock Mines Produce Enormous Wealth for Ontario

The vast wealth of northern Ontario’s and Northwestern Quebec’s hardrock mines was funneled into Toronto’s financial district making the city the mine financing capital of the world.

Ontario’s internationally recognized mining supply and service industries – the two most important clusters are located in the Greater Toronto Area and Sudbury – export their technical hard-rock mining expertise, knowledge and products around the world.

By any economic measurement, the Ontario government has received an extraordinary return on their original investment in funding the Temiskaming and Northern Ontario Railway! However, there was a dark side to those 130 years of mineral development. Thousands of men were killed or maimed in unsafe working conditions, there were no environmental controls, landscapes were destroyed, waterways polluted, unions were brutally suppressed and Aboriginal communities did not share in the economic prosperity. But we must remember the context of the times.

What was acceptable fifty or hundred years ago is not tolerated today. The Mining Watch report legitimately highlights many environmental, Aboriginal and social challenges in the Ring of Fire.

But, over the past twenty-five years, the mining sector has made enormous strides in cleaner, environmentally sustainable mining practices, workplace safety and the implementation of corporate socially responsible initiatives that extensively involve Aboriginal participation.

The Northwest Territories three diamond mine’s social impacts, during the past twelve years, have included $600 million in Aboriginal business revenues, increased Aboriginal secondary school enrollment from 36 to 56 percent and reduced Aboriginal recipients on social assistance by 50 percent.

The tremendous mineral potential of the Ring of Fire, not only could help the Ontario government’s deficit ridden budgets but also make a substantial impact in alleviating impoverished living conditions in the region’s First Nations communities.

The Ring of Fire transportation infrastructure should be subsidized by taxpayers as the economic and employment returns will be benefiting Ontario’s economy for generations to come.

END