One of Canada’s pre-eminent photojournalists explores one of man’s oldest obsessions in the heart of the Brazilian Amazon

We’ve all heard tales of the men who followed the lure of gold into harsh wilderness, turning over the land with brute force, often finding little more than the community of fellow dreamers. Legendary gold rushes took place in California, Victoria, and the Klondike in the second half of the nineteenth century, right around the time the camera was invented.

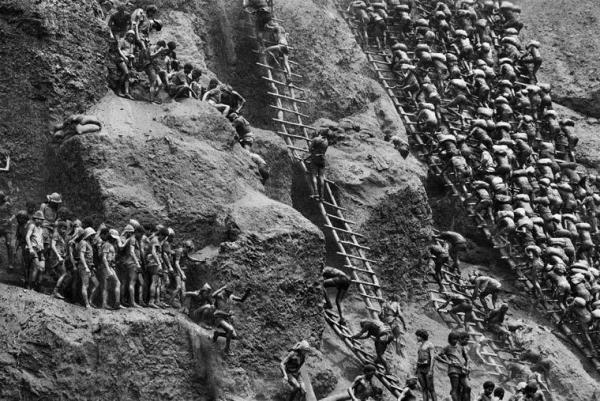

But while portrait photography caught on quickly in cities, hauling giant glass plates into the bush was next to impossible, so the gold rush phenomenon went almost completely undocumented visually. Not until the advent of hand-held cameras like the Leica could photographers portray stories unfolding in remote locations—which is exactly what Sebastião Salgado did when the Serra Pelada gold rush broke out deep in the Brazilian Amazon, circa 1980.

When I was starting out in photography, Salgado was king. He had taken the “concerned photographer” mission global, producing massive books on broad social themes, with an unprecedented combination of artistry and salesmanship. His Serra Pelada—black and white shots of some 80,000 mud-caked miners—was an account of epic, almost biblical human undertaking.