Established in 1980, Northern Ontario Business provides Canadians and international investors with relevant, current and insightful editorial content and business news information about Ontario’s vibrant and resource-rich North. This article was published in the October, 2010 issue.

For an extensive list of articles on this mineral discovery, please go to: Ontario’s Ring of Fire Mineral Discovery

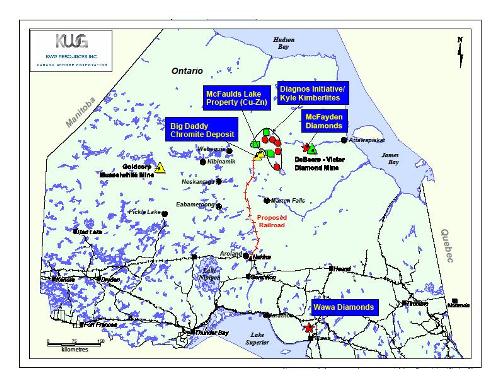

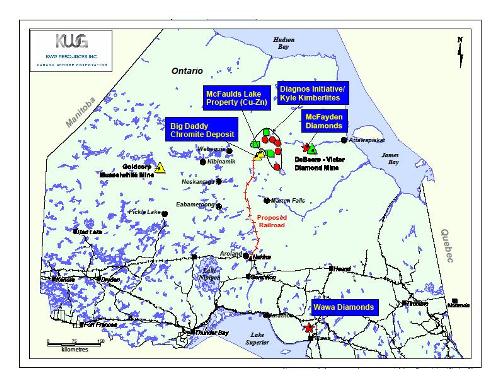

Despite the frenzy of exploration drilling and company acquistions in the Ring of Fire, engineering work continues for a proposed chromite ore haul railroad into the James Bay lowlands.

Krech Ojard & Associates is preparing a rail feasibility study for the construction of a 350-kilometre-long railroad from McFaulds Lake, south to Exton in northwestern Ontario.

The preferred route would largely follow glacial eskers that start south of the Albany River. These gravel rises make for ideal track bed in an otherwise swampy landscape.

Nels Ojard, special projects manager at Krech Ojard, said the majority of work this past summer was focused on the geotechnical program.

Soil samples that were collected along the length of the route last winter and spring were being processed and evaluated to test their ability to support heavy bridge loads and frost susceptability.

This article originally appeared in the Fall/Winter 2010 issue of the Ontario Prospector which is published by the

This article originally appeared in the Fall/Winter 2010 issue of the Ontario Prospector which is published by the