Metals Economics Group’s 21st Corporate Exploration Strategies study

U.S. dollar currency is used throughout this press release

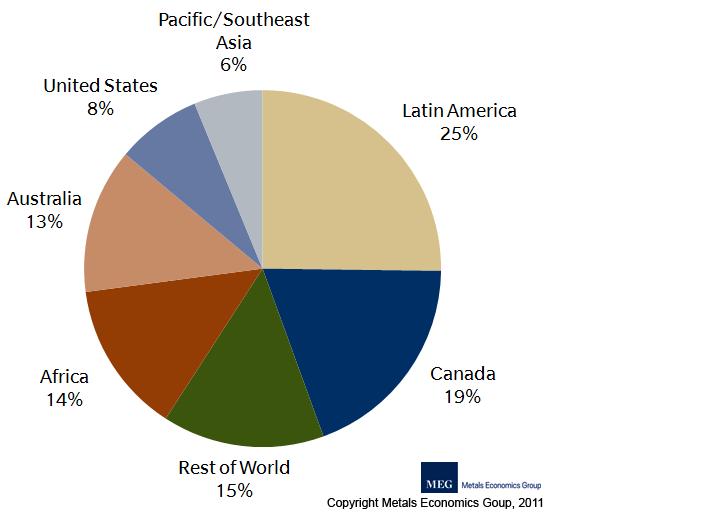

Worldwide nonferrous exploration budgets by region, 2010

(more than 2,200 companies’ budgets, totaling US$11.5 billion)

(Note: The annual budget totals for Canada, Australia, and the United States

are typically much larger than those of most other countries; as a result,

MEG treats these countries as individual regions in its CES studies.)

Vancouver, British Columbia, January 24, 2011 – Canada maintained the regional number-two spot for planned exploration spending in 2010, attracting 19% of worldwide nonferrous exploration allocations. According to Metals Economics Group’s Corporate Exploration Strategies (CES), Canada has held second place for nine years since overtaking Australia in 2002. (Metals Economics Group’s study covers expenditures for precious and base metals, diamonds, uranium, and some industrial minerals; it specifically excludes iron ore, aluminum, coal, and oil and gas.)

Four provinces—Ontario, Quebec, Saskatchewan, and British Columbia—accounted for more than three-quarters of the $2.2 billion in planned Canadian nonferrous exploration spending in 2010. Of the 710 companies that planned to explore in Canada in 2010, 90% were based in Canada, together contributing 79% of the planned Canadian nonferrous exploration total. Worldwide, Canadian-based companies accounted for more than half of the 2,200+ active explorers covered by the 2010 edition of CES, and together accounted for 41% of the 2010 global exploration budget total.