BCBusiness, is British Columbia’s foremost business authority and the most widely read business publication in the province. This article was originally published January 01, 2009.

BCBusiness interviewed the following three key players about the current state of mining in British Columbia:

Terry Lyons-Chair Northgate Mineral Corp.

“In Canada there is no urgency to move projects to a “yes” or a “no.” And I will tell you over and over again, the industry doesn’t mind “no.” Say “no” and let us move on with our lives and our shareholders’ capital. But to waste five, six, seven, eight years because the bureaucrats in the government cannot make a decision or don’t want to make a decision doesn’t do anybody any good.”

Ken Boggio-PricewaterhousCooper LLP

“You look at China, for example: almost 7,000 privately held coal mines and reports that 250 or more people die each week in these coal mines. Do you want your steel being made from coal mined in China or would you prefer to have it come from the Fording properties in southeastern B.C.?”

Byng Giraud-Vice-President of Policy and Communications Mining Association of British Columbia

“We estimate between 25 and 30 projects in this province that could become mines are somewhere in the environmental testing or permitting process. And when I talk about political will or societal will to open a few extra mines in this province, that could mean the difference between recession and not. It’s that significant. We’re talking billions of dollars of capital investment and construction. Thousands of jobs. Building communities. The upside is huge.”

Mine Games

Sitting in a room with a group of high-profile insiders in the B.C. mining industry, the one thing that stands out is a sense of rejection, of an industry that built cities and towns across the province asking, “Do you want us here or not?”

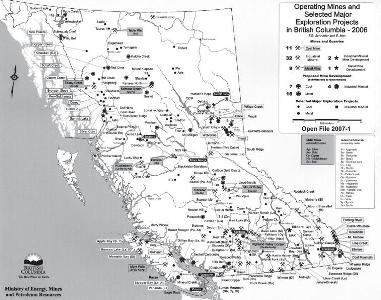

Vancouver is a centre for mining in the world, with hundreds of companies engaged in raising money and spending it on far-flung geological studies, exploration missions, mine developments and extraction efforts. But when it comes to digging mines in B.C. itself, the picture is bleak. Mines across the province are reaching retirement age, and no promising young mines have come on scene to take their place since the mid-’90s.

Not that the province’s many miners aren’t trying. But the hurdles standing in the way of digging a new hole in B.C. are enormous, be they economic, social, environmental, logistic or simply bureaucratic. It’s enough to make miners wonder if they’re really welcome here at all.

Read more

Hidden in the Rock – Porphyries (British Columbia)

Hidden in the Rock – Porphyries (British Columbia)