Since 1915, the Northern Miner weekly newspaper has chronicled Canada’s globally significant mining sector.

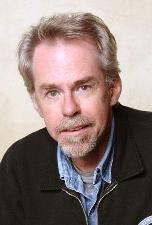

Intense. Passionate. Tenacious. Shrewd. Visionary. These are the words that come to mind when describing The Northern Miner’s Mining Person of the Year: Andre Gaumond, president and CEO of junior explorer Virginia Gold Mines.

Gaumond is a graduate geological engineer from Laval University in Quebec City and holds a master’s degree in economic geology from Montreal’s Ecole Polytechnique.

Early in his mining career, from 1987 to 1990, Gaumond worked as a mining analyst for several financial institutions, including Pemberton Securities and Midland Walwyn.

He then joined Corpomin Management as a technical and financial consultant, where he held management positions in various mineral exploration companies.

In 1993, Gaumond reorganized Virginia Gold Mines, assumed the title of president, and moved its head office to Quebec City — not a mining centre, but a picturesque city, ideal for his young family.