To order a copy of Spooky Sudbury, click here: http://www.dundurn.com/books/spooky_sudbury

For a CBC Sudbury interview with Mark Leslie, click here: http://www.cbc.ca/morningnorth/past-episodes/2013/10/01/spooky-sudbury/

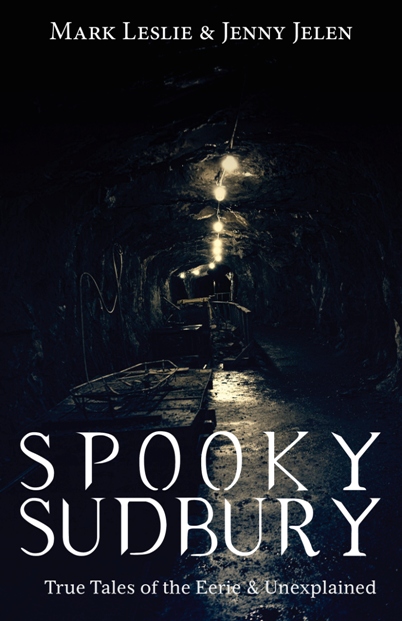

Haunted 2650 Level of Levack Mine

It is a well-known fact that shift work and general over-tiredness can often lead to a change in perception, a blurring of the lines between reality and the dream world. In his 1996 book, Sleep Thieves, Stanley Coren described the effects of sleep-deprivation on our physical and mental health.

One such side-effect has to do with hallucinations. Coren documented what happened when Peter Tripp, a New York City DJ, decided to go without sleep for two hundred hours for a charity fund-raising event. Early into the experience, Tripp experienced distortions in his visual perceptions: he was inter-preting spots on the table as bugs, seeing spiders crawling around his booth, and even spinning webs on his shoes.3 Later on, Tripp was so susceptible to delusions that he became convinced that the doctor monitoring his health was actually an undertaker there to bury him alive. Tripp could no longer properly distinguish between reality and his nightmares.

Tripp’s experiences are perhaps a bit extreme, but Coren also includes multiple references to the effect of shift-work on internal circadian clocks. He illustrates how workers on rotating shifts tend to sleep two less hours per day, spend most of their time sleeping in the lightest stages of sleep, and thus typically suffer from sleep deprivation and build up a significant amount of sleep debt.