Michael Barnes is the author of more than fifty books about characters, communities, mining, and police work. He is a Member of the Order of Canada and makes his home in Haliburton, Ontario, Canada. While living in Northern Ontario most of his life, he has come to know and admire those who make their living in the mining industry.

To order a copy of “Fortunes Found – Canadian Mining Success” go to: General Store Publishing House

Stan Sudol with his blog “The Republic of Mining.com” does the industry a great service by bringing out topical and historical articles. (Michael Barnes – Fortunes Found: Canadian Mining Success – 2010)

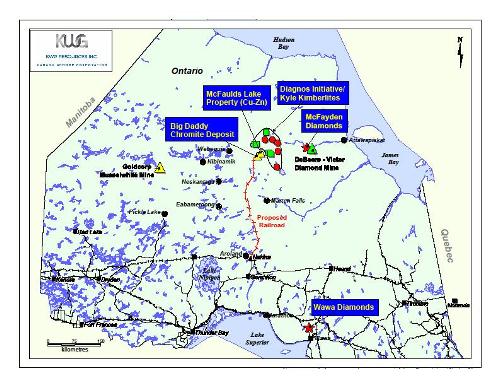

In 2006, the City of Greater Sudbury Development Corporation enlisted the support and input of various community, business, and labour groups to form a task force on the future of the local mining industry. When the group came to put its conclusions into print form, it turned to a local son now resident in Toronto.

Stan Sudol is a writer and consults on mining issues. Since he has written extensively on Sudbury mining and the nickel industry, he was chosen to author “Claiming Our Stake — Building a Sustainable Community.”

The paper has become Sudbury’s policy core regarding the mining industry. With a century of experience in mining, the city is a most welcome place for all aspects of the industry. The major companies, all levels of government, and the various communities must support moves in the area of training, innovation and research, and reclamation.