The Globe and Mail is Canada’s national newspaper with the second largest broadsheet circulation in the country. It has enormous influence on Canada’s political and business elite. Brenda Bouw is the Globe and Mail mining reporter.

A battle is shaping up between global mining giant Rio Tinto PLC and Canada’s Cameco Corp. over a promising uranium explorer in Saskatchewan, with Cameco under pressure to win as it seeks to double production of its single resource.

London-based Rio has struck a friendly deal to buy Hathor Exploration Ltd. for $578-million or $4.15 a share, topping Cameco’s hostile offer of $3.75 a share made in late August.

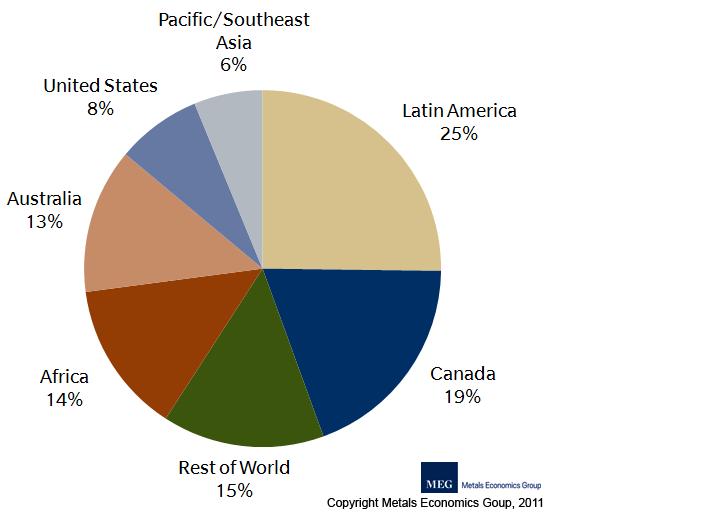

The companies are vying for control of Hathor’s assets in the uranium-rich Athabasca Basin of Saskatchewan, where about 20 per cent of the world’s uranium is produced. Both bids come as the price of uranium, used to fuel nuclear power plants, struggles to recover from a slump since the nuclear crisis in Japan last March caused many countries to re-examine their nuclear power programs.

With the long-range belief that nuclear energy will expand in key growth countries such as China and India, Rio is looking to expand its existing uranium operations in Australia and Africa. Its offer for Hathor is the first Rio has made for a Canadian company since its ill-timed purchase of Montreal-based aluminum producer Alcan in 2007, on the eve of the global recession.