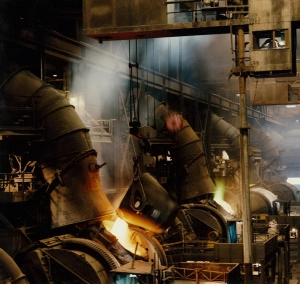

Sudbury, ON, September 14, 2018 — Today Vale Canada Limited announced the completion of its CAD $1 billion Clean AER (Atmospheric Emission Reduction Project) with a celebration near its Smelter Complex in Sudbury, Ontario.

“The completion of our Clean AER Project is a historic milestone that demonstrates how far we have come as a company in reducing our environmental footprint,” said Ricus Grimbeek, Chief Operating Officer of Vale’s North Atlantic Base Metals Operations and Asian Refineries. “It is something that all of us at Vale and our local community can be very proud of.”

Vale’s Clean AER Project is the largest single environmental investment in Sudbury’s history, achieving an 85% reduction in previous sulphur dioxide emissions and a 40% reduction in metal particulate emissions.