The Toronto Star, which has the largest circulation in Canada, has an enormous impact on Canada’s federal and provincial politics as well as shaping public opinion. This article was originally published May 24, 2011.

TARIME, TANZANIA—Families of the five men killed by security forces of a Canadian mine are furious after that were denied permission to hold a memorial service Tuesday at African Barrick’s gold mine in North Mara.

“When you have lost your loved ones and you are in a grieving period, for someone to do this to you, it is not right. It would be better if they would take you too,” said Magige Gati, whose 27-year-old son Emmanuel Magige was among the dead.

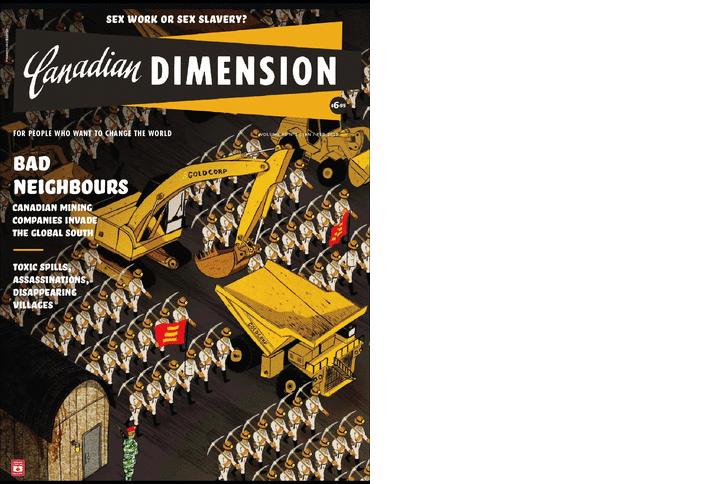

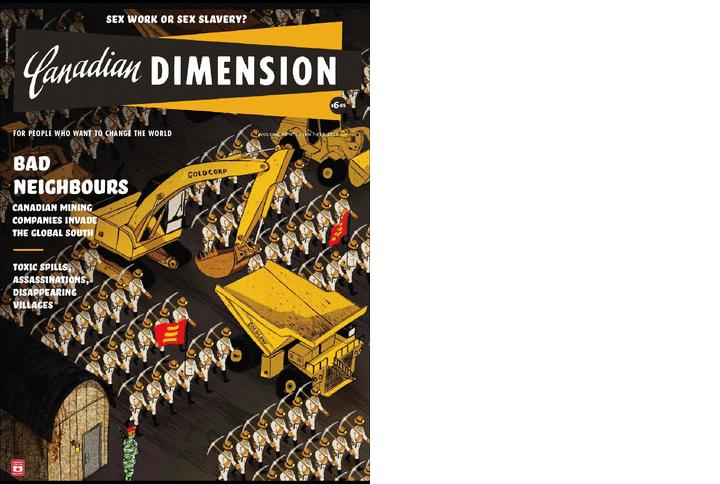

Five men were killed, and at least a dozen injured, when about 800 locals clashed with security on May 16 at a mine in the area owned by African Barrick, a subsidiary of Toronto-based Barrick Gold Corporation.

The clash is the latest episode in an ongoing conflict between residents of North Mara, who come to the mine to scavenge for gold and Barrick, which took over the mine in 2006.