Date: 25th March 2013

Release time: Immediate

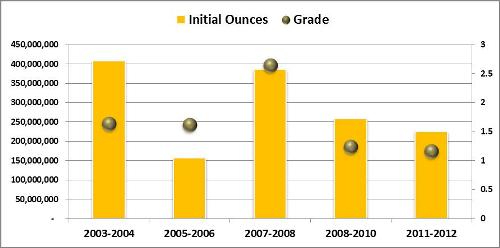

The declining rate of new gold discoveries and grades across the global market during the last decade has accelerated over the last 4 years.

Data and analysis from IntierraRMG reveals that the 2 year period from 2003 to 2004 was the best in the study range, with over 400 million ounces of new gold discovered. This includes inferred, indicated and measured ounces with an average grade of 1.65 grams per tonne. In contrast, 2005 and 2006 had the lowest number, with just over 150 million new gold ounces discovered – albeit with a similar grade.

Discoveries then increased significantly during 2007 to 2008 with greater than 390 million ounces. The average grade also increased significantly to 2.65 grams per tonne; the highest in the 10 year period.

Over the next two years, slightly more than 250 million ounces were discovered with a declining grade of 1.25 grams per tonne. This deterioration continued through 2011 and 2012 as the amount of new gold ounces discovered dipped below 225 million ounces with a reduced grade of 1.17 grams per tonne.