The Toronto Star, which has the largest circulation in Canada, has an enormous impact on Canada’s federal and provincial politics as well as shaping public opinion.

But local leaders accuse the company of complicity in the conduct of the police,

because it employs officers to provide mine security, and allege that African Barrick

is benefiting from it. (Jocelyn Edwards) “A community that has been intimidated is a

community that can’t demand its rights from the company.” (Tanzanian MP Tundu Lissu)

Reporter for the Star questioned in Tanzania as string of arrests follows deaths at Barrick site

KAMPALA, UGANDA—Given that I had been followed around the tiny town for two days by men in ’80s-style wraparound sunglasses, it wasn’t really a surprise to me when I finally got arrested last Thursday in northern Tanzania.

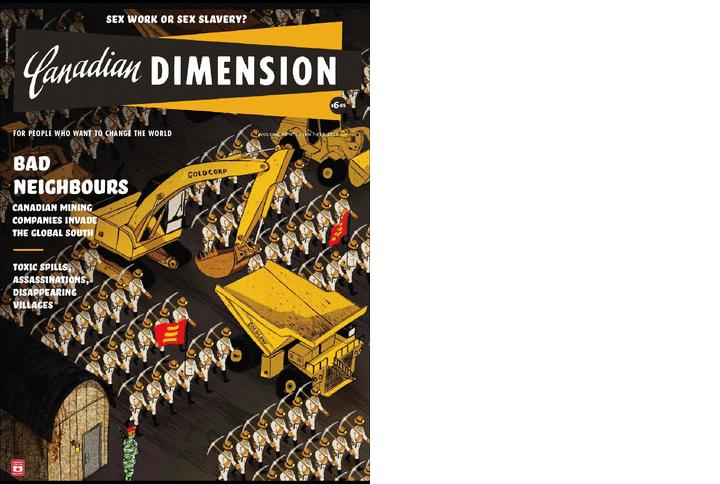

I had gone to the East African nation to investigate the deaths of five villagers gunned down at a mine in North Mara belonging to African Barrick, a subsidiary of Toronto-based mining giant Barrick Gold Corp. Barrick said the men killed by security forces — initial reports had pegged the death toll at seven — were “intruders.” Family members of the victims said the gold-laced stones the men routinely collected at the mine were their only means of survival.

Trucks of police in full riot gear patrolled the streets of Tarime, the town nearest the mine. The situation was tense and relatives of the deceased were huddled together in a compound.

Tuesday morning, I woke up and found the room next to mine empty. The environmental and human rights lawyer who had been staying there had been arrested, along with seven other people who had been guarding the bodies of the victims at the town mortuary.