Women working for International Nickel

Women working for International Nickel

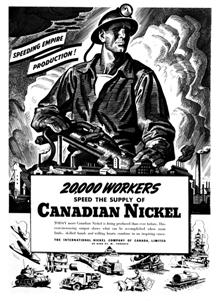

Since 1890, Ontario mining legislation had prohibited the employment of women in mines. Using its powers under the War Measures Act, the federal government issues an order-in-council on August 13, 1942 allowing women to be employed, but only in surface operations. On September 23, 1942, a second order-in-council was issued to allow women into the Port Colborne refinery.

Over 1,400 women were hired for productions and maintenance jobs for the duration of the war. They performed a variety of jobs such as operating ore distributors, repairing cell flotation equipment, piloting ore trains and working in the machine shop.

Twenty-one year old Elizabeth “Lisa” Dumencu, a resident of Lively, a Sudbury suburb, answered the call. “Women didn’t normally do this type of work, but we had to do our part,” she recalls. “It was really remarkable, but my husband Peter, worked even harder underground at Creighton mine.”

• Thank you, and good afternoon everyone. It’s been a little while since I spoke to the Chamber, so it’s a pleasure to be here.

• Thank you, and good afternoon everyone. It’s been a little while since I spoke to the Chamber, so it’s a pleasure to be here. Prosperity, modernity, pioneer color and a relief problem

Prosperity, modernity, pioneer color and a relief problem “We had the pick of the geologists’ crop in the depressed mining sector of 2002 and subsequently built one of the country’s biggest, youngest and most innovative exploration teams,” continues MacGibbon. “And with all that historical data, our fantastic computer- literate staff played a key role in helping us decide where to drill.”

“We had the pick of the geologists’ crop in the depressed mining sector of 2002 and subsequently built one of the country’s biggest, youngest and most innovative exploration teams,” continues MacGibbon. “And with all that historical data, our fantastic computer- literate staff played a key role in helping us decide where to drill.” “Our company has a strategic position in the trillion-dollar Sudbury Basin which by far, is the richest mining district in North America,” observes Terry MacGibbon, executive chair of FNX Mining Company Inc. “With China’s and eventually India’s voracious hunger for metals, expected to last for decades, the long-term growth and future of our company on solid ground.”

“Our company has a strategic position in the trillion-dollar Sudbury Basin which by far, is the richest mining district in North America,” observes Terry MacGibbon, executive chair of FNX Mining Company Inc. “With China’s and eventually India’s voracious hunger for metals, expected to last for decades, the long-term growth and future of our company on solid ground.” With such turmoil on global stock exchanges, one might wonder if Xstrata CEO Mick Davis and Vale CEO Roger Agnelli are trying to perform their proposed merger/takeover – difficult enough at the best of times – on the deck of a financial Titanic.

With such turmoil on global stock exchanges, one might wonder if Xstrata CEO Mick Davis and Vale CEO Roger Agnelli are trying to perform their proposed merger/takeover – difficult enough at the best of times – on the deck of a financial Titanic.