Western Areas managing director Dan Lougher has fired a warning shot to nickel laterite developers, questioning whether the oncoming battery boom will make high-cost projects viable.

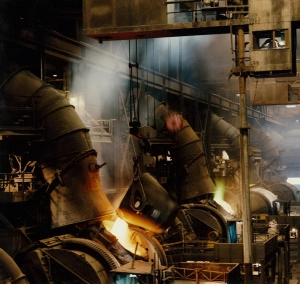

The euphoria around the potential for lithium ion batteries to transform demand for their highest volume ingredient and rising prices for cobalt have prompted owners of a string of low-grade lateritic projects to dust them off. Large-scale nickel laterite mines can be costly to both build and process, often relying on a chemical-intensive process called high-pressure acid leach to extract the resource.

Mr Lougher told delegates at the Diggers and Dealers forum in Kalgoorlie-Boulder today the battery market would be a growing contributor to nickel demand over the next decade, which was still dominated by steel makers, but that high-grade nickel sulphide producers would be the quickest to scale up for the new market.