Christina Blizzard is the Queen’s Park columnist for the Toronto Sun, the city’s daily tabloid newspaper. christina.blizzard@sunmedia.ca

Remember a couple of years ago, Premier Dalton McGuinty said this province

could no longer count on “pulling stuff out of the ground” for jobs? All goes to

show just how wrong he was. And how out of touch, not just with northern Ontario,

but with the economy. (Christina Blizzard – June 10, 2011)

Mining companies spending billions here in search of riches. So why did Dalton McGuinty blow them off?

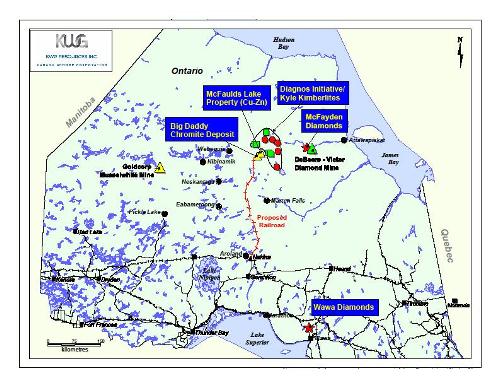

Skyrocketing world gold prices are providing a boost to this province’s northern economy, as mining companies look to old mines in search of the precious metal.

Detour Lake gold mine, near Cochrane, will be the largest gold mine in Canada when it starts production in 2013. Based on today’s spot gold price, it will generate more than $1 billion a year for 21 years, says Detour Gold President and CEO Gerald Panneton.

And while the price of gold, like all resources, fluctuates, he says gold’s been around for 6,000 years and it’s here to stay. “People have tried to push it away and then get rid of it, but it always came back,” Panneton said in an interview.

Gold is tough to replace and is the most versatile, malleable element you can find. “If you try to accumulate value in silver or copper or zinc, you’ll need a huge warehouse,” he said.

Prosperity, modernity, pioneer color and a relief problem

Prosperity, modernity, pioneer color and a relief problem