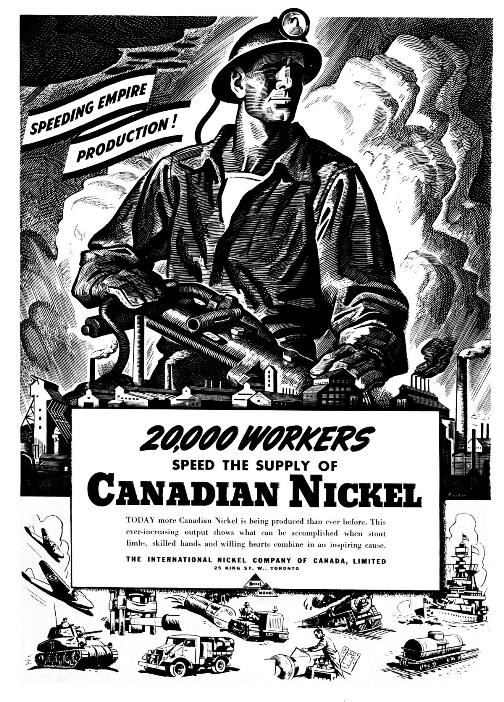

Franco-Nevada chairman calls Inco takeover ‘an unmitigated disaster,’ 10 years on

This week, we’ve been marking the 10-year anniversary of Inco agreeing to a takeover by Brazil’s Vale. Along with the sale of Falconbridge to Xstrata of Switzerland shortly before, the deal saw the biggest mines in Ontario’s rich Sudbury basin pass into foreign hands.

One of the elder statesmen of Canadian mining told BNN that allowing the sale of the two nickel producers to non-Canadian buyers a decade ago was “a huge political mistake, to let two giant Canadian companies go.”

Pierre Lassonde, chairman of royalty and streaming player Franco-Nevada (FNV.TO 1.56%), said “Australia would have never done that. They would never have let BHP (BHP.N), for example, go. With that, the head office left and the jobs and the research…. I think it has been an unmitigated disaster.”