Murchison Minerals Limited (TSXV: MUR) is a company founded by industry veterans and following a plan for discovering and building resources for the Green Energy Revolution through high-grade Cu-Zn and Ni-Co projects in Canada’s best mining jurisdictions.

Murchison is operating in the provinces of Saskatchewan and Quebec, based on those provinces’ rich variety of metal deposits, as well as the positive fiscal and operational environment for mineral exploration and development. In its 2020 Annual Survey of Mining Companies the Fraser Institute ranks those jurisdictions as the top two in Canada and in the top ten globally.

The Green Energy future is not just about electric vehicles and battery power. Clean energy goes beyond this to include Wind, Solar, Hydrogen Energy Cells, Geothermal and even Nuclear. Other drivers of the future will be the electrification of everything, the 5G interconnection of devices (managed by AI systems), and energy-efficient systems.

Both the US and EU Governments have put forward economic recovery plans that stress green energy, electrification and the digital economy. These plans are yet to kick in as the political process of approving the plans move forward.

US President Joe Biden, has proposed US$1.74 trillion of stimulus, which includes the promotion of EV adoption, and aims to strengthen domestic lithium battery supply chains. The European Commission estimates that investment needs amount to at least €1.5 trillion in 2020-2027.

Investment in key sectors and technologies, from 5G to artificial intelligence and from clean hydrogen to offshore renewable energy, holds the key to Europe’s future. This future would see strong demand for a wide range of base and precious metals.

After crashing in the early days of the Covid-19 pandemic copper prices have recently jumped near to all-time highs, crossing the US$10,000/tonne barrier for the first time in a decade. A basket of base metals including aluminum, nickel, copper, tin, lead and zinc is trading at levels only reached twice in modern history: in 2007-08 and 2011.

Zinc prices have surged to the highest level since June 2018. In just the last three months copper prices have risen by 30% and zinc prices by 15%. Present demand is being driven by demand from China, the only country actually recovering from 16 months of pandemic-related disruption.

Demand for copper is projected to increase by up to four times and zinc demand may double as recovery commences in other parts of the globe. “Investment by Mining companies needs to be nearly $1.7 trillion in the next 15 years to help supply enough copper, cobalt, nickel and other metals needed for the shift to a low-carbon world,” according to consultancy Wood Mackenzie.

A readily available high-grade base-metal mine with good access and infrastructure in a mining-friendly location is a hard thing to come by in this day and age.

Murchison in Saskatchewan – Brabant Project

Murchison’s flagship project is the 100% owned Brabant Project, 175 kilometres northeast of La Ronge, Saskatchewan, with excellent surrounding infrastructure including provincial highway, grid power, water and service centres. It is accessible year-round by a 1 km drill/winter road, that connects it to Provincial Highway 102 at a point approximately 2 km north of the settlement of Brabant Lake.

There is significant mining history in the region: the Anglo Rouyn copper mine operated from 1966 to 1972 on a VMS deposit similar to Brabant, and the SeaBee gold mine of SSR Resources that has operated since 1991.

Murchison has a close and supportive relationship with local aboriginal communities and governments. Murchison has adopted a Sustainability Policy whereby they are committed to operating in a safe, socially and environmentally responsible manner, contributing to the prosperity of their employees, their families and respecting human rights, culture, custom and values of the people and the communities in which they operate.

Geologically the Brabant Property is located within the Reindeer Zone of the Early Proterozoic Trans-Hudson Orogen. The Brabant-McKenzie deposit is located in a similar geological environment as the Flin Flon, Lalor Lake, Lynn Lake and Snow Lake deposits. Previous studies on the Brabant-McKenzie VMS deposit concluded that it lies in a similar geological setting and is of the same age as the Flin Flon VMS mining camp in Manitoba.

This is a high-grade Volcanogenic Massive Sulphide (VMS) deposit hosting an NI 43-101 compliant Resource of 2.1 Mt @ 10% ZnEq(Indicated) and 7.6 Mt @ 6.3% ZnEq(Inferred). The deposit consists of two parallel, generally north-northeasterly striking and moderately west-northwesterly dipping zones referred to as the Upper and Lower Zones. To date 175 diamond drill holes (51,400 metres) have tested the Brabant-McKenzie Deposit and regional targets.

The project’s huge land package in Saskatchewan also has significant exploration upside and remains open for expansion, covering an area of 626.9 km2 that is highly- prospective for VMS-type deposits and also the potential to identify high-grade strata-bound metasedimentary gold deposits resembling the numerous, other-known gold deposits in the region.

Murchison has currently identified approximately 120 airborne EM conductors across the Brabant Project from geophysical surveys in 2012, 2018 and 2020. Murchison continues to add to the land package when justified by ongoing exploration work.

Recently field prospecting focused on the 35 new anomalies identified by the VTEM airbourne survey and located on the same geological horizon that hosts the Brabant-McKenzie deposit. This suggests that a cluster or camp of deposits may exist on the project area. Based on the results of the survey Murchison has increased its holdings along the trend.

In 2021, two diamond drill holes were completed on the Betty Zone 1 km northeast of the Brabant-McKenzie deposit, and intersected narrow widths of VMS-type mineralization grading up to 9.22% ZnEq. Follow-up downhole geophysics identified a 700 m X 200 m conductor at Betty, additional drilling will be undertaken in Q3 2021. Potential for gold and graphite deposits are noted within the Brabant Project.

Murchison in Quebec – HPM Project

From the management team’s past involvement in Quebec Murchison also owns 100% of the HPM nickel-copper-cobalt project in Quebec. HPM Ni-Cu-Co land package is located south of the Petit-Lac-Manicouagan (a water reservoir that feeds the Hydro-Quebec’s Hart-Jaune hydroelectric complex) at approximately 275 km NNE of Baie-Comeau and 135 km south of Fermont. These towns are linked by the allweather Provincial Road 389, that goes through the closed iron mining town of Gagnonville, where the paved airstrip is still in usable condition.

Murchison’s Haut Plateau de la Manicouagan (HPM) property is located 60 km east of the Manicouagan crater in eastern Quebec. The 58 km2 HPM property is host to numerous Ni-Cu-Co showings associated with mafic to ultramafic intrusions, including the high-grade Barre de Fer magmatic nickel sulphide occurrence. The Barre de Fer occurrence returned up to 1.74% Ni, 0.90% Cu, and 0.09% Co over 43.18 m in historic diamond drilling.

Results from this short reconnaissance prospecting program in conjunction with historic results provide additional encouragement for a follow-up program at HPM. The HPM property holdings cover the prospective geological unit that hosts significant nickel-copper-cobalt mineralization identified by a total of 32 diamond drill holes (6,479 m) completed in 2001-2 and 2008.

The HPM project contains numerous gossanous nickel-copper-cobalt-bearing outcrops spatially linked to historical airborne EM anomalies. It is well-known that the Voisey’s Bay Mine, some 620 km from the HPM project, was originally prospected and mapped as a pyritic gossan.

Historically, exploration and drilling on the HPM property focused on the immediate area around the Barre de Fer showing. The anomalous Ni-Cu-Co results from mafic intrusions 0.5-2.5 km outside of that area, obtained from the recent reconnaissance prospecting program, demonstrate the potential for a mineralization system that is larger than previously thought.

In 2020 a 1,440-line kilometre airborne magnetic survey (MAG) with a 50 metre line spacing was completed covering the entirety of the HPM project. This survey provides high-resolution detail of geological and structural features that will aid in identifying additional magmatic intrusions which could host nickel, copper and cobalt mineralization.

In April, 2021 Murchison Minerals Ltd. commissioned a VTEM airborne geophysical survey to follow-up on promising recent ground-prospecting results. The Geotech VTEM 655-line kilometre survey over the HPM property will be flown with a 100 metre line spacing. Murchison has also commissioned a satellite remote-sensing study to detect alteration signatures on the property which, when completed, will integrate all pertinent data including the airborne survey to identify the most prospective drill targets in this coming field season. A Final Report is pending.

Barraute

As of May 2021 Murchison announced that it has entered into an agreement granting an option to earn 100% interest in 75 mineral claims covering 2,377 hectares. These claims are composed of four blocks are located in the Barraute-Landrienne mining camp, approximately 60 km north of Val-d’Or, and about 4 km northwest of the municipality of Barraute in Quebec and were selected targeting new zinc-silver-gold deposits. These four blocks of claims are believed to host some of the best untested geological/geophysical base-metal targets in the area and are considered ready for drilling.

The Barraute mining camp hosts several mineralized showings and polymetallic metal deposits including the substantial 15.7 Mt zinc-silver Abcourt-Barvue deposit located at only 2 km from the Barraute property. Here, as in Saskatchewan the target is a cluster of high-grade, VMS-type deposits.

Investment Perspective

Murchison continues to demonstrate that it has the ability to select well-located properties, and to discover and grow mineral resources containing commodities expected to grow in demand and increase in price. Modern scientific exploration techniques are used alongside of traditional approaches. Drill targets are abundant giving numerous opportunities for additional discovery. Follow-up work continues to be encouraging.

Murchison’s Projects are in locations and jurisdictions that regard mining favourably, and have solid regulatory systems, with regulations that are well-established. The geological environment is well-understood by management. They have well-developed relations with communities that will provide a stable base for future development. The Brabant-McKenzie deposit is a significant resource on its own and there is excellent potential for other similar sized deposits on the existing Saskatchewan land package.

As the world progresses in recovery from the pandemic increasing demand for all metals in the face of limited supply and restricted ability to ramp-up production quickly will drive prices higher making the holders of base-metal resources more valuable. The US Biden administration has indicated that the metals required for its recovery program spending will be be obtained from trading partners rather than expanding mining production domestically. This enhances the position of Canadian mineral deposits in the face of a “Buy American” policy.

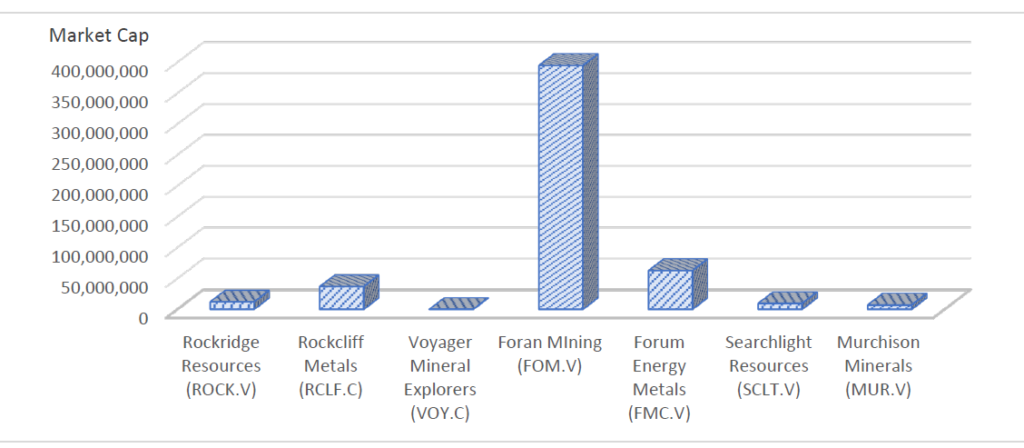

A chart of other participants in the same region and commodities as Murchison has been developed. Highest value appears to be given to the most advanced projects. Issuers with a Mineral Resource outlined have better value than the early-stage explorers. Murchison appears relatively undervalued in this analysis. The value of the Brabant-McKenzie deposit appears to not be adequately recognized. The market appears to be awaiting further development of the deposit. Value for the HPM project and for the recent acquisition of the Barraute project is under-represented, potentially waiting for drilling results later this year.

Stephen has more than 45 years Mineral Industry experience, including 25 years of Management and Board service with junior mining companies. He is experienced in the full life cycle of Mining projects, from grass roots exploration, through resource building, financial evaluation, construction and development, operations and closure. He is a Qualified Person for NI 43-101 reporting, and is skilled at mining project valuations at all stages.