At Prospectors and Developers Association of Canada (PDAC) 2018 mining convention, Rockcliff Metals was a typical struggling junior with a great land package in the lesser known but geologically-rich Flin Flon – Snow Lake (FF-SL) greenstone belt with eight high-grade VMS base-metal deposits and five promising lode-gold properties.

It was starting out to be a tough year and unfortunately an even rougher start the week before the convention when Rockcliff CEO Ken Lapierre slipped on the freshly fallen snow, when he was taking out the garbage. Not thinking much about his sore ankle, the six-foot, three inch, former hockey playing, karate practising jock, started shoveling the driveway. Twelve hours later, the swelling and pain in his left ankle demanded a trip to the doctor where he learned that it was broken and that he had torn all the soft tissue.

For the entire PDAC convention, the largest and most important in the world, for juniors to meet potential future investors and current shareholders and financiers, Lapierre had to use a knee walker that resembled a scooter to get around, along with a substantial amount of painkillers.

To add salt on his broken ankle, a failed financing with B.C. investors was confirmed during the convention. And a smaller than expected mid-year financing which allowed some exploration work as well as a three-to-one stock consolidation, further highlighted all the struggles junior companies endure and that continues to plague the entire exploration sector to this day.

Ken Lapierre says, “There was no doubt, the first half of 2018 was turning into one of our toughest years ever. But the Flin Flon – Snow Lake camp has such enormous potential. With a hundred years of mining activity, I believe our strategically consolidated properties in that camp will favourably position our company. There are many more Tower deposits to be found as well as our promising gold properties two of which caught the interest of Kinross.”

One of the few bright spots was Rockcliff’s high-grade copper/zinc Tower deposit – which had been sold to Norvista Capital, a merchant bank for a 1.5% royalty – was being investigated for production by the bank’s Akuna subsidiary. Norvista has equity positions in a portfolio of four core investments located in Canada, the United States and Mexico, all located in excellent mining jurisdictions and are involved in both base and precious metals exploration and development.

Founded by Ken Lapierre in 2005, Rockcliff Metals has followed the highly successful Sudbury-based FNX model of acquiring non-core assets from the dominate producer in an established mining district – in this case, Hudbay Minerals, with whom the junior has a terrific relationship with. In addition, Rockcliff has picked up other promising land packages from staking property, and completing deals with prospectors or other juniors, with the intention of making a big discovery or building on its present resources through exploration success through the drill bit, which would lead to becoming a mine finder.

$29 million Greenstone and Additional Retail Financing

However, in the fall of 2018, Lapierre was approached by Greenstone, a private equity fund, who was impressed by the junior’s commanding land package in the FF-SL greenstone belt and the terrific potential of the company’s deposits. Greenstone has approximately US$430 million in committed long-term capital primarily focused on the mining and metals sector.

Ken Lapierre says, “Greenstone liked what we had and also liked what Norvista had but loved them both together. What a difference a year makes!”

At the PDAC 2019, Rockcliff was negotiating a return of two significant assets with Norvista which would see Rockcliff take back the high-grade copper-zinc Tower deposit and its option to earn a 51% interest in the high-grade copper-zinc Talbot deposit, as well as a leased +1,000 tpd permitted mill just up the highway from both these assets for an equity position in the transitioned company. Norvista which previously owned approximately six per cent of Rockcliff would see its ownership stake increase to 28% from a new share issue.

Greenstone, which previously owned no shares would acquire about 42% from that new share issue for the aggregate value of roughly $20 million. An additional $8.76M was raised through private sector flow-through funding that finalized the company’s transition to a fully funded $29 million mine developer and explorer!

Rockcliff moved from the Toronto Venture Exchange to the Canadian Securities Exchange due to significant cost savings and the ability to make these major transactional decisions in a shorter time frame.

As a major component of Rockcliff’s strategic initiative to become a mid-tier copper/zinc producer, Alistair Ross was recently hired as President and CEO to lead the company in its next phase of growth. Ross has a broad spectrum of mining experience and innovation in both small and large-scale projects. Past work history includes Rio Tinto in Zimbabwe, Phelps Dodge in New Mexico and President of Lonmin’s South African operations from 2005 to 2008.

He also spent a combined seven years with Inco/Vale, most recently responsible for the team that rebuilt and introduced new mining technology into the Sudbury underground operations which consisted of six mines and approximately 2,000 employees.

Alistair Ross says, “Rockcliff has amassed a great track of land, already developed several near-term production opportunities, and has many more prospective targets that are worthy of rapid and intensive exploration. I also look forward to implementing state-of-the-art mining technology in our development projects that should see a 15% improvement in bottom line performance over conventional mechanized mining methods.”

Through this major transformation Lapierre will become the VP of Exploration, his core strength. Ken Lapierre says, “I am delighted to take on the role of VP of Exploration and to be part of the management team that will be responsible for taking Rockcliff to the next level in its life cycle. With over 100,000 metres of exploration drilling to be completed over the next 20 months, the Company is poised for tremendous growth through the drill bit as we transition Rockcliff into a mining company.”

Tower Project/Mill/Transitioning to Mine Development Production

The first property to be looked at for a production scenario is the Tower deposit, which has exceptional grade, excellent infrastructure, low-cost electricity and low capital costs, all important attributes to bring a mine into production.

Ken Lapierre says, “We look forward to working with our First Nations communities and will continue to nurture a positive and productive relationship as we transition from an explorer to a developer and finally into a producer.”

Rockcliff is using a hub and spoke development strategy from a centralized milling facility that allows the company to transition into a copper-focused producer with low capital costs. As part of the transaction, Rockcliff had acquired a 7-year processing lease on the Bucko Mill and tailing storage facilities at the Bucko Lake Mine near Wabowden, Manitoba.

With 100% ownership of the Tower property, Rockcliff will begin to develop a high-grade 1.08M tonne NI 43-101 Indicated mineral resource grading 3.73% Cu, 1.05% Zn, 0.55 g/t Au and 17.28 g/t Ag. In addition, the deposit also contains a 1.25M tonne NI 43-101 Inferred mineral resource grading 2.0% Cu, 1.02% Zn, 0.27 g/t Au and 9.78 g/t Ag.

Rockliff initial goal is to grow into a 15,000 to 20,000 tonne per year copper producer and our ultimate goal would be to achieve annual production of plus 50,000 tonnes per year.

Kinross Buy-in on Two Gold Properties

In April 2018, Kinross had optioned the Laguna and Lucky Jack gold properties for $5.5 million in expenditures for a 70% interest. Both gold properties are centered within the historic Herb Lake Gold Camp, Manitoba’s first and highest-grade gold camp.

The first two years of its $1.25 million commitment was completed within the first six months. Kinross has elected to continue with the option buy budgeting an additional $1 million during 2019 which will include more diamond drilling.

The Laguna Mine historically produced 60,000 ounces of gold averaging over 20 grams/tonne up to the late 1930s and was last drilled in 1944. Back then the mine was called Herb Lake Mine and production stopped due to its lack of sustained exploration to replace dwindling reserves due to the second world war and never restarted. The Snow Lake VMS mining camp was originally known for gold. Historic gold production (1916 – 2005) from this camp was between 1.5 and 2 million ounces at relatively shallow depths. There is a 2,000 tpd gold mill within trucking distance of the Laguna and Lucky Jack properties.

Bur High-grade Deposit Results

Another promising project is the Bur zinc property which hosts the high-grade historical Bur Zinc Deposit and is strategically located 22 kilometres by road from Hudbay Minerals’ copper-zinc concentrator centred in the Snow Lake camp. It is considered one of the highest-grade undeveloped zinc-copper VMS deposits in the belt and is open along strike and at depth.

In a May 21, 2019 news release, Rockcliff announced near surface high-grade massive sulphides at Bur from their phase two winter drill program. 17.95% ZnEq across 5.7 metres and 15.03% ZnEq across 4.42 metres were just some of the promising drill highlights. Rockcliff intends to drill over 10,000 metres in 2019 to prove up additional resources.

Background on Extraordinary Rich 100-Year Old Flin Flon – Greenstone Belt

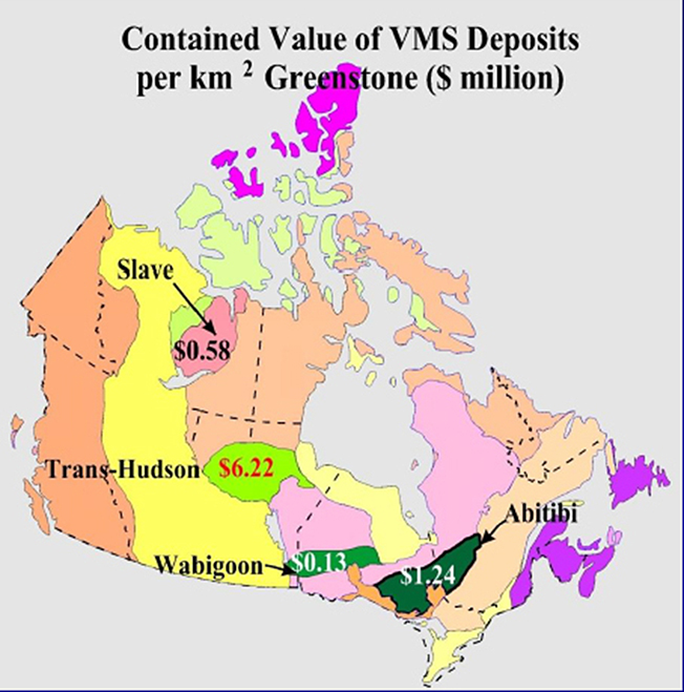

The above map is from a past presentation given by James Franklin, one of Canada’s most respected geoscientists. Franklin was the chief geoscientist at the Geological Survey of Canada from 1993 to 1997. He is one of the country’s top experts on the Canadian Shield geology. The Trans-Hudson is where the Flin Flon – Snow Lake greenstone belt is located. It is the most prolific and highest-grade Paleoproterozoic Volcanogenic Massive Sulphide (VMS) district (copper, gold, zinc, silver) in the world and also contains gold mines and gold deposits.

In Canadian terms, the contained value per square kilometre of this greenstone belt is significantly more than the better-known Abitibi belt that crosses northeastern Ontario and northwestern Quebec.

The FF-SL greenstone belt is 250kms long – the western section intrudes into Saskatchewan – and 150kms wide. As the geologically rich Sudbury Basin was the starting basis for the old Inco and Falconbridge, the equally rich FF-SL greenstone belt was the basis for Hudbay Minerals’ rapid growth which started in 1930 in Flin Flon, Manitoba.

The extraordinary geological belt has historically been home to over 30 high-grade base metal (copper/zinc) mines and eight gold mines. The FF-SL Greenstone belt is roughly divided in two halves. The northern half of exposed Canadian Shield outcrops where the vast majority of exploration has been completed and the mines have been found.

Ken Lapierre says, “The southern half is covered with limestone and as a result has had significantly less exploration in spite of the fact that this greenstone belt is greater in size under the limestone cover. It is only in the last few decades that geophysical programs have been able to penetrate below the limestone and identify areas where the highly conductive mineral deposits have concentrated.”

Grade is King!

Nineteen of the 30 VMS mines that have gone into production since the 1930s began with less than two million tonnes of reserves. And during their mine-life the mine reserves on average grew by 2.5 times with additional drilling.

The greatest example of this is the legendary Flin Flon mine which started production in 1930. The initial resource was 14Mt but over 60Mt was produced over the next 62 years until the mine closed in 1992. Since the first Hudbay mine went into production, the FF-SL greenstone belt has produced slightly over 200Mt of VMS copper, zinc, gold and silver production.

The town and original deposit’s name is taken from the lead character in a paperback novel, The Sunless City by J. E. Preston Muddock. Josiah Flintabbatey Flonatin piloted a submarine through a bottomless lake where he passed into a strange underground world through a hole lined with gold. A copy of the book was allegedly found and read by prospector Tom Creighton who discovered the deposit.

Subsequent historical research has largely confirmed that Aboriginal trapper, David Collins, is the person who showed Creighton the Flin Flon deposit. Creighton being a professional prospector, knew the significance of the discovery, while Collins did not. For the record, both men deserve equal billing as co-discoverers.

The town of Flin Flon grew considerably during the 1930s as farmers, who were impoverished by the Great Depression, abandoned their farms and came to work at the mines.

Hudbay Minerals Operations in the FF – SL Greenstone Belt

With almost 90 years of mineral production in the FF-SL camp, Hudbay Minerals still has many ongoing operations. Their 777 mine, which started in 2004, produces zinc, copper, gold and silver. The mine life is expected to be until 2021. The Lalor mine also produces zinc, copper, gold and silver and is located in the Chisel Basin of the Flin Flon greenstone belt. Initial production began in August 2012 and the mine reached commercial production in the third quarter of 2014.

The company also has processing facilities that include the Flin Flon concentrator and a modern zinc plant in the town of Flin Flon. In addition, a refurbished concentrator in Snow Lake process roughly 3,000 tonnes per day of ore production from the Lalor mine and produces zinc and copper concentrates.

Rockcliff Land Holdings in FF-SL Greenstone Belt: The Geological Treasure Chest of Manitoba

Rockcliff Metals Corporation’s extensive portfolio of properties totals over 4,000 square kilometres, making the junior the largest landholder in the Snow Lake portion of the world-class geologically rich FF-SL greenstone belt – elephant country!

It includes nine of the highest-grade undeveloped VMS deposits and five lode-gold properties including the historic Rex-Laguna gold mine, Manitoba’s first and highest-grade gold mine, all within trucking distance to processing facilities.

Manitoba is consistently rated as one of the top mining jurisdictions, according to the well-respected Fraser Institute annual report on mining companies as well as being one of most permitting-friendly provinces in Canada. Highways and rail infrastructure, low cost electric power, local mining expertise and labour, First Nations support and agreements and several operating mines and mills are part of the prolific FF-SL mining belt.

Over the next two years, Rockcliff will implement one of the largest copper-zinc focused exploration programs undertaken anywhere in the world by a junior resource company. It will include almost 100,000 metres of drilling that will give Rockcliff the potential to significantly increase its existing resource (10 million tonnes VMS copper, zinc, gold, silver – indicated, inferred and non- NI 43-101 historic) with deposits that are open in all directions.

Kinross will continue to advance the optioned two gold properties and Rockcliff will initiate further exploration on the company’s three other promising gold properties.

In addition, in the near term, the Company intends to become a 15,000 to 20,000 tonnes per year copper producer through its advanced copper deposits and intends to grow that figure with the advancement and development of their other promising VMS properties.

Alistair Ross says, “Rockcliff Metals offers investors the rare combination of early production potential and significant exploration upside in a jurisdiction that is highly conducive for mining investment. The assay results announced in Rockcliff’s May 21, 2019 news release from the winter drill program on the Bur high-grade zinc project are an excellent example of our significant exploration upside.”

In summary, this financing and asset acquisition has created a well-capitalized base and gold metals focused developer and explorer with high-grade deposits, a significant land package of highly prospective exploration ground and access to concentrate production facilities intending to unlock the full potential of company’s extensive property portfolio.

Ken Lapierre says “Rockcliff Metals is a de-risked opportunity, in a de-risked jurisdiction, run by mine builders and discoverers that have done it all before and supported by a major tier 1 Private Equity mining and metals firm as a new cornerstone investor. In this market, it doesn’t get any better than that!”

Stan Sudol is a Toronto-based communications consultant, freelance mining columnist and owner/editor of RepublicOfMining.com, a mining news aggregator website.