Click here for the Tetra Tech Trade-Off Study: http://www.kwgresources.com/_resources/Rail_vs_Road_Tradeoff_Study_Report_FINAL_11Feb2013.pdf

TORONTO, ONTARIO–(Feb. 21, 2013) – KWG Resources Inc. (TSX VENTURE:KWG) (“KWG”) has released a study that it commissioned by the international engineering firm Tetra Tech WEI Inc. to compare the capital and operating costs of both a railroad and an all-weather road to the Ring of Fire. The study estimates the capital costs for a roadway at $1.052 billion and a railroad at $1.561 billion. If 3 million tonnes per year are shipped, operating costs are estimated at $10.50 per tonne for the railroad and $60.78 per tonne for trucking on the road. If 5 million tonnes per year are shipped, it is estimated that those operating costs per tonne would be reduced to $6.33 for rail and $59.28 for trucking.

The complete study has been posted on the KWG website: www.kwgresources.com and should be read in its entirety to understand the assumptions made by the authors of the study in order to derive the foregoing conclusions.

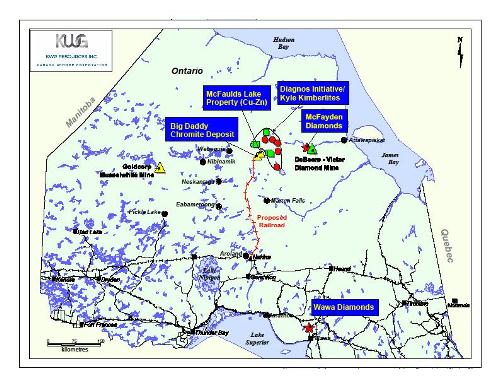

About KWG: KWG has a 30% interest in the Big Daddy chromite deposit and the right to earn 80% of the Black Horse chromite where resources are being defined in a drilling program this winter. KWG also owns 100% of Canada Chrome Corporation which has staked claims and conducted a $15 million surveying and soil testing program for the engineering and construction of a railroad to the Ring of Fire from Exton, Ontario.

This press release contains or refers to forward-looking information. All statements, other than statements of historical fact that address activities, events or developments that KWG believes, expects or anticipates will or may occur in the future are forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the construction of a rail line or roadway from Nakina to the Ring of Fire and the estimated capital and operating costs associated with each option. Estimates from the study arise from engineering and costing work of Tetra Tech WEI Inc. and KWG.

This forward-looking information reflects the current expectations or beliefs of KWG based on information currently available to it. In connection therewith, numerous factors and assumptions have been considered, which are detailed in the Tetra Tech WEI Inc. study, including (without limitation) assumptions regarding the manner, method and timing of rail and road construction, contractors and construction personnel, capital cost increases, the construction of temporary access roads, environmental conditions and topography, and hauling and importing costs. Although KWG believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future actions and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results to differ materially from the conclusions or forecasts discussed in the forward-looking information, and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on KWG. Factors that could cause actual results or events to differ materially from current expectations include, but are not limited to, delays in, or the failure to, develop the projects of KWG caused by unavailability of equipment, labour or supplies; weather and climatic conditions; labour disputes; financing or other factors; capital and/or operating costs for, among other things, the construction of a rail line and/or roadway varying from estimates; ability to access capital markets and financing; and risks normally incidental to exploration and development of, and production from, mineral properties and/or adverse changes in securities markets, economic and general business and financial conditions.

Forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws.

http://www.facebook.com/kwgresourcesinc

http://twitter.com/kwgresources

http://www.youtube.com/KWGresources

Shares issued and outstanding: 691,577,273

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact Information

KWG Resources Inc.

Bruce Hodgman

Vice-President

416-642-3575

info@kwgresources.com