Global Mining Finance was created four years ago as an annual book to provide international mining executives and their peers in the financial community with an overview of the industry from a World-wide perspective. For the main website: http://www.globalminingfinance.com/past-editions.html

The following research on nickel was provided by Paradigm Capital, a research-driven investment dealer, providing Research, Trade Execution and Investment Banking services.

Commodity Focus – Nickel

Two-thirds of all nickel produced goes into stainless steel, but is also important in the world of hi-tech where the soft magnetic properties of nickel and its alloys are employed. In this article, Paradigm Capital takes a look at the market for nickel.

Demand: Driven by The Stainless Steel Recovery

Nickel has a high rate of recyclability, This distinction is often made between the use of newly produced metal and recycled scrap. By far the most important first use of nickel is the production of stainless steel which accounts for over 60% of total demand with other first-use sectors being alloys, casting, electroplating, chemicals and batteries. The stainless steel sector is growing at a CAGR of about 5-6% per annum.

The nickel market rebounded strongly in 2010 compared to a very weak 2009, as a result of improved stainless steel demand conditions in combination with an amplified restocking period. In addition, the austenitic ratio (i.e. nickel bearing stainless steel) which has traditionally run at around the 75% level, has slipped lower. This was due to nickel’s meteoric price rise in 2007 to $25/lb. which proved to be the catalyst that triggered substitution, particularly into lower nickel bearing intra stainless steel grades. This proved to be one of the double whammies.

The austenitic ratio dropped by approximately 5% but the subsequent fall in the nickel prices has helped recoup a portion of this lost market share. In addition, lower scrap availability has helped to boost primary nickel demand as historically 50% of stainless steels feedstock has been derived via stainless steel scrap.

Scrap is sourced from revert which is generated internally by the mills, fabricators and from old scrap (demolition of plants after their 20-year useful life). Typically, both revert and fabricated scrap supply tend to lag as a result of the low level of manufacturing activity during a sharp economic downturn.

Global stainless steel output in 2010 is expected to reach the 30 million tonne mark versus 25.2 million tonnes in 2009, an increase of 19% y/y. The total quantity of stainless steel to be produced by China, India, the Middle East and South America is expected to represent ~50% of this output. The nonstainless steel sector such as foundry and nickel alloys report improved market conditions from the aerospace, oil and gas, and power generation industries. Demand in these sectors was squeezed during 1H 2010 by the prolonged Vale strike in Sudbury which created a supply shortage/premium increase for high purity nickel.

Supply: An Unexpected New Source of Supply Emerges

The global economic downturn induced severe production cuts of just under 300,000 tonnes versus plan during 2009 to help re-equilibrate the market. Most of the cuts were market-related, but the Vale Sudbury/Voisey’s cuts were strike-related.

BHP Billiton Ravensthorpe (45ktpa) and Xstrata Falcondo (30ktpa) were major casualties of the downturn. Typically, market analysts use a disruption allowance of 2-4% but in 2008 it was 11% and in 2009 a whopping 21%.

The economic downturn was the catalyst behind a long list of project delays including Ramu (33tpa), Onca Puma (58ktpa), Barro Alto (43ktpa), Vermelho (46ktpa), Niquelandia (11ktpa), Buruktalski (11ktpa), Ambatovy (60ktpa), Moa (12ktpa), Eagle (16ktpa) and Amplats (12ktpa) for a total of approximately 300ktpa with at least a 1-year delay. In addition, BHP’s Ravensthorpe mine has been suspended indefinitely but, with the recent sale of the project to First Quantum, could see first commercial production as soon as 2012. Two other high-profile projects that are moving forward, Ambatovy in Madagascar (60kpta) and Koniambo in New Caledonia (60ktpa), are expected to deliver first nickel by mid-2011 in the case of Ambatovy and late-2012 in the case of Koniambo.

Nickel Pig Iron (NPI) emerged as a new nickel supply source in China during 2006 but really hit the market as the second double whammy in 2007 to help secure nickel units for the Chinese stainless steel industry and help alleviate the nickel pricing pressure. Imported limonite ore mainly from Indonesia and the Philippines was treated in blast furnaces to generate a crude ferronickel of around 5% nickel contained.

The blast furnace NPI has almost exclusively gone into 200-series stainless steel where both quality constraints and nickel content are lower. Electric arc furnace capacity is now being utilized and blends with conventional ferronickel process feed (saprolitic laterites mainly from New Caledonia) to generate a lower impurity product with grades averaging 10% nickel contained. While still low grade and treated as a scrap competitor, this grade of NPI with an integrated producer provides an option to LME priced nickel and ferronickel with a very high iron content.

During the last few years, the 5% NPI grade is estimated to have a breakeven point of $7.50/lb. and the 10% NPI grade one of $6.50/lb., but this supply source has some challenges. First, it is an energy intensive process and, given the upward pricing pressure on coking coal and Chinese power costs, the break-even cost is experiencing upward pressure. In addition, the blast furnace material has deleterious elements that require blending. Being environmentally unfriendly, the process is also susceptible to forced closure as the Chinese government is pushing for cleaner, more environmentally friendly technologies. Annual 2010 NPI production is estimated to be 150,000 tonnes.

Is Nickel Facing a Tsunami of Supply?

First and foremost, sulphide miners such as Vale/Norilsk are suffering from rapidly declining ore grades and will struggle to maintain their production profile. The impact of a wave of new nickel projects was originally supposed to be felt in 2009, but technical problems have forced Vale to push back the start of Goro and First Quantum’s (ex-BHP) Ravensthorpe project remains a question mark.

The upcoming HPAL laterite leaching projects account for half of the scheduled increase in nickel supply by 2015. Hence delays to ramp up, production short falls and higher costs will have a major impact on the balance outlook, future prices and the competitive landscape. We believe that the reliance on future supply coming from HPAL projects will prove to be problematic and will be highly supportive of sustainable, higher nickel prices.

HPAL projects are technologically complex, highly capital intensive, have very long ramp up times, have high opex costs as they need to treat large volumes of low grade ore, are highly sensitive to varying ore quality grade and have a poor track record of meeting guidance.

The catch 22 is that future nickel supply will largely be reliant on supply from laterite nickel deposits utilizing HPAL technology that has a capital intensity of $35/lb.+, which is double what it was a decade ago. These nickel units are required by the market to fill the future supply gap.

Market Balance and Pricing Outlook

Despite the improved demand prospects for nickel, the two short-term wild cards come from the supply side of the equation: How will the handful of large greenfield HPAL nickel projects ramp up? How much Chinese nickel pig iron will be produced? From a high of $25.00 per pound in the fall of 2007 nickel prices collapsed to a low of approximately $4.00, 12 months later.

The price of nickel was one of the star performers in 2010 versus other industrial metals, reflecting the strong rebound in demand as a result of the massive stainless steel restocking cycle (See chart below).

With NPI being one of the highest marginal cost producers and the government crackdown on inefficient, polluting industries becoming more stringent, this naturally makes the Chinese NPI industry a swing producer. As nickel prices gravitate towards the break-even price, market supply will start to be curtailed and as the nickel price rises, NPI production will ramp up accordingly. In addition, new supply is coming on-stream from HPAL laterite deposits which have a high capex and typically experience start up issues translating into higher opex costs. With stainless steel demand providing solid underpinnings to the projected long-term compound average growth rate in nickel demand of 4% per annum, the required supply for equilibrium requires the onset of one new project per year in the order of magnitude of 50-60Ktpa.

Of the handful of HPAL projects scheduled to hit the market over the next few years, we view the Ambatovy project to have the highest chance of success due to Sherritt International and Sumitomo’s successful involvement in the Moa Bay and Coral Bay projects, respectively. The implication of this supply dynamic, we believe, is that the market should be fairly balanced in terms of supply and demand with prices trading, on average, in a tighter minmax range estimated to be $7-$13/lb. If the hydomet projects are successful, the risk is towards the lower end of this range as they replace the higher cost nickel pig iron production. If not, and nickel pig iron is needed by the market, then the higher end of this range is more likely.

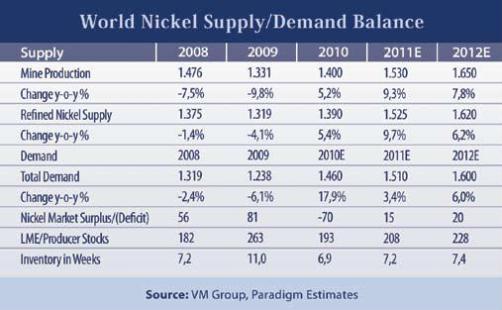

Nickel has been riding copper’s coattails, benefiting from both its strong fundamentals and investment interest. Despite the expectation for the nickel market balance to move into a small surplus in 2011 and 2012, its fundamentals are looking fairly decent (see Table above).

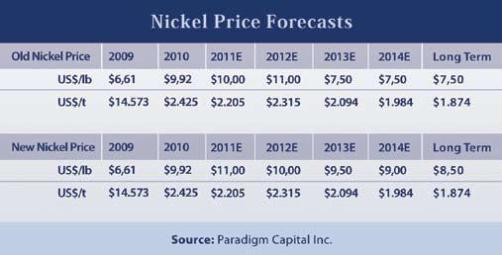

With the expectation of a postponement / cancellation of hydrometallurgical projects, a solid demand recovery outside of China and strong investment demand interest, we have reversed our 2011 and 2012 price forecast and increased our prices for years 2013 and 2014.

We have also upped our long term price forecast from US$7.50 to US$8.50 to reflect higher capital intensity and operating costs given the reliance on the hydromet projects to deliver future supply. (See Table below).