An edited version of this list was published in the February/March issue of the Canadian Mining Journal.

Four Americans Made the List!

A few months ago, my dear colleague Joe Martin, who is the Director of the Canadian Business & Financial History Initiative at Rotman and President Emeritus of Canada’s History Society, asked me a very simple question: who would be considered the most important individual in Canadian mining?

Considering Canada’s lengthy and exceptional expertise in the mineral sector, it was not an easy answer and I decided to research and create a top ten list of the most important mining men in Canadian history.

The lack of women on this list simply reflects the fact that for much of our history most women were not given the educational or social opportunities to excel in business, especially in a rough and male-dominated sector like mining. Times have changed, women are playing key roles in mining today and will definitely be included on this list in the future.

However, a few qualifiers need to be established. This is basically a list of mine builders not mine finders. Building a company through takeovers and discoveries is one way but I am also focusing on individuals who have built corporate empires and/or who have developed isolated regions of the country with the necessary infrastructure for mines to flourish and create multi-generational jobs, shareholder wealth and great economic impact.

In most cases, these individuals had enormous clout and influence with the Canadian business establishment and have left an enduring legacy that may still impact a community or the industry today. I primarily focused on gold and base-metal miners though some companies did have coal mining divisions.

I have included both Americans and Canadians as there really was no border between our countries when it came to mining expertise, capital and movement of skilled labour for much of our shared history.

Historica Canada Ignores Country’s Vibrant Mining History

This list is also very timely as Canada is celebrating the 150th anniversary of confederation next year – a fitting reflection of the enormous contributions that the mining sector has made to the development of many northern parts of our vast country and unfortunately, are largely ignored by our mainstream media.

In fact, the very popular Historica Canada website with their well known “Heritage Minutes” – one of the major sources of history to most Canadians – does not mention one single mining discovery or its social and economic contributions among over 180 videos. Only a brief mention of the Klondike gold rush in relation to one profile on legendary North West Mounted Police officer Sam Steel and another video highlights geologist Joseph Tyrrell’s discovery of dinosaur bones in the badlands of Alberta. And of course one video on the Springhill, Nova Scotia, 1958 mining disaster!

This is an astonishing and shameful example of how Canadian mining history has been dismissed and forgotten, ironically by an organization whose mandate is to ensure we do not forget our vibrant past! Located beside the richest country ever that desperately needed our mineral products for its industrialization – the very first commodity super cycles – the past 150 years of Canadian history is also a history of mining.

We pride ourselves as “miners to the world!” Historica Canada would do well to look at the individuals on this list and learn of a vibrant and exciting mining sector filled with visionary individuals with guts, greed and glory that are well worth celebrating!

Saskatchewan Premiers Blakeney, Devine and Wall – Extraordinary Policy Impact

Before I start my list, I need to make an “Honorary Mention” of three Saskatchewan premiers and their relationship to the world-class potash and uranium deposits in that province.

Left leaning NDP Premier Allan Blakeney nationalized four key potash mines – roughly 40% of provincial production – in 1975 and formed a crown corporation called Potash Corporation of Saskatchewan. In addition, the Saskatchewan Mining Development Corporation was formed the year before to oversee the government’s interests in uranium, gold and diamond exploration and mining.

Conservative Premier Grant Devine privatized both these crown corporation in 1988. The Saskatchewan Mining Development Corporation was combined with the privatized federal crown corporation Eldorado Nuclear to form Cameco Corporation which today is the largest private sector producer of uranium – roughly 18 per cent – in the world from mines in Canada, the U.S. and Kazakhstan. And Potash Corp. is the largest producer of fertilizers in the world.

In 2005, conservative leaning Brad Wall shocked the business establishment by not allowing Potash Corp. to be taken over by BHP Billiton. Depending on where you stand in the political spectrum these policy decisions would be viewed favorably or negatively. It is not the intention of this column to pass judgement but only to highlight the fact that these three premiers have had more of an impact on the history of mineral development in Saskatchewan than any business individual.

Cobalt – Cradle of Canadian Mining

A brief historical tangent is in order before we continue. During the construction of the provincial Temiskaming and Northern Ontario Railway in 1903 to colonize the north, silver was discovered by workers at a station called Cobalt.

Many historians have often called the Cobalt Silver Boom “the cradle of Canada’s mining industry.” Cobalt enhanced the prospecting and mining capabilities of Canadians and most importantly, provided the necessary financing for future mine development. Roughly 100 mines were developed over the life of the camp and an astonishing 460 million ounces of silver produced.

Author Douglas Baldwin, who wrote the definitive history of Cobalt stated, “For the next half century, nearly every major discovery in Canada – from Noranda to Eldorado to Elliott Lake – was due to the skills and financial resources acquired at Cobalt.”

The silver boom and subsequent discoveries was the primary reason the Toronto stock exchange, the banking community and Toronto became a global mine financing powerhouse.

Prospectors, mine developers, managers, engineers, financiers and bankers all learned their trade and gained valuable insight from this frenzy of mining activity. In addition, during the first decade of the 20th century, important technological advances in mining and metallurgy were being discovered and applied at Cobalt that were adopted throughout Canada and the world, solidifying Canadian mining expertise that is still respected today.

10) The Golden Boys – Noah Timmins (Hollinger Gold Mines) and Harry Oakes (Lake Shore Mines)

Sharing the tenth spot on the list is Noah Timmins and Harry Oakes well known mine builders in the Timmins and Kirkland Lake camps respectively. Noah Timmins along with his brother Henry started out as owners of a general store in Mattawa, Ontario and first struck it rich with purchased claims in the Cobalt silver boom that made them mining millionaires. Haileybury barber Benny Hollinger and his partner Alex Gillies claim staked some promising ground in the Porcupine Gold Rush in 1909. They sold out to Noah Timmins who oversaw the construction of and ran one of Canada’s legendary mines, the Hollinger which produced 19.3 million ounces of gold over 58 years before it finally closed in 1968.

The town of Timmins is named after Noah and he ensured that it would develop in a more orderly fashion than the chaos of Cobalt. The company built a hospital, sporting facilities and even funded small retailers. Noah Timmins through the Hollinger invested in other mining interests including the Noranda Horne Smelter and gold mines in Quebec, Manitoba, Kirkland Lake, Yellowknife and the Yukon.

He was called “one of the great mining magnates of Canada” by the Toronto Star and known as “Grand Old Man of Canadian Mining” when he died in 1936.

American-born and well-known for his cantankerous personality, Harry Oakes played an instrumental role in transforming Kirkland Lake into one of the world’s most significant gold camps. After about a decade of travelling the world’s most promising gold mining districts, including the Klondike, Africa, Australia and the American West, Oakes came to Kirkland Lake in the summer of 1911. His ultimate goal was to establish a prospector built and owned mine. However, the first mine in the Kirkland Lake camp – the Tough-Oakes, later named the Toburn – was built by Oakes in conjunction with the Tough brothers.

In total, seven gold mines were built along a single fault or strike zone, but the richest one of all was Oakes’ Lake Shore Mines which through his shear diligence and tenacity finally started to pay off in 1918 when high-grade section of gold was discovered. Oakes became the richest man in Canada from the earnings of the Lake Shore mine, the largest employer in Kirkland Lake. Due to high taxes, Oakes finally left the country for the Bahamas in 1934 where he was murdered in 1943. To this day they have never found the culprit. In total, the Lake Shore produced roughly 8.5 million ounces of gold until it was shut down in 1968.

9) Francis Clergue and his Iron Ore Legacy at Algoma Steel

American-born entrepreneur Francis Hector Clergue founded Sault Ste. Marie based Algoma Steel in 1901 – now owned by Essar Steel – and created an industrial empire due to the development of iron ore deposits north of that city.

Prospectors Ben Boyer and Jim Sayer discovered promising hematite (iron) ore in the Michipicoten/Wawa area in 1898. Clergue bought the claims for $500.00 and built the Helen Mine – named after one of his sisters. He also constructed a power plant, pulp and paper mill, a steam ship line and a rail road which lead to the industrial development of the isolated Algoma district.

The projects had tremendous government support from both levels as industrialists where very concerned that Ontario would not be able to prosper and grow if the province could not establish a viable iron and steel manufacturing sector.

Throughout the next century, Algoma Steel experienced many booms and busts, nearing financial bankruptcy and being bailed out with government support a number of times. Iron ore production continued in the Wawa district until 1998. However, Clergue’s industrial legacy which includes the steel operations, railroad and other ventures still endure to this day, garnering the number nine spot on this list.

8) Gilbert A. Labine – A Fateful Destiny With Uranium (Eldorado)

The pitchblende that Gilbert Labine discovered in 1930 at Great Bear Lake in Canada’s Northwest Territories became the critical source of the fissionable material for the first atom bombs that were dropped on Hiroshima and Nagasaki, ending the Second World War.

A high school dropout from Pembroke, Ontario who headed to the Cobalt Silver boom where he unfortunately did not strike it rich but learned everything he could about mineralogy and geology at classes at the Mining Institute in Haileybury – a genteel community adjacent to the rough and tumble town of Cobalt.

Years of lackluster success finally brought him to the pitchblende discovery and the construction of the famous Eldorado uranium mine and a refinery in Port Hope that produced both radium and at that point, uranium which had no market value but which was wisely stockpiled. He broke the stranglehold the Belgiums had on the radium market from their mines in the Congo. Labine’s operations had to close due to poor demand until World War Two and the urgent need of uranium for the American Manhattan Project.

The Canadian government nationalized the Eldorado mine in 1944 for strategic reasons making Labine President. He stayed until 1950 discovering another uranium mine – Eldorado Beaverlodge mine – for the corporation. On his own, Labine discover two more mines, the larger being the very profitable Gunnar on the shores of Lake Athabaska in northern Saskatchewan.

7) Thayer Lindsley – A Mining Genius (Falconbridge Limited)

Born in Japan to American parents, Thayer Lindsley, the founder of Falconbridge is in the seventh spot. Lindsley is considered one of the great mine finders and company builders in the history of Canadian mining. A true international mine executive, he found or was involved with the development of many well-know companies including Sherritt Gordon, Giant Yellowknife, Canadian Malarctic, United Keno Hill as well as developments in Africa and Australia.

However, one of the largest companies he is credited for building into an international powerhouse is Falconbridge Limited. In 1928, Lindsley along with a group of investors that included his brother founded Ventures Ltd. as a holding company for a variety of properties as well as incorporating Falconbridge Nickel Mines as a subsidiary of that company.

The original owner of the Falconbridge claims was Thomas Edison who gave up his hunt for nickel when his exploration drilling encountered quicksand. Lindsley purchased the claims and developed the company’s first nickel mine in competition with the dominate International Inco. Due to Inco’s stranglehold on refining technology in North America, Lindsley bought the Kristiansand refinery in Norway which is still in operation.

Lindsley served as president and a director of both Ventures and Falconbridge for 28 years. By 1960, Falconbridge had six mines in the Sudbury Basin and two years later Ventures Limited was merged with Falconbridge. Even at the age of 90, four years before his death in 1976, Lindsley was still working on mining projects around the globe.

6) Robert C. Stanley – The Grandfather of the Nickel Industry (International Nickel Ltd.)

Until the end of World War One, the primary use of nickel was for amour-plated steel which was made into a wide variety of military products including tanks and the feared dreadnoughts, the primary battleships used by navies in Europe and the U.S.

With the end of military conflict in 1918, the market crashed and it is widely said that Robert Stanley, President of International Nickel basically saved the company by establishing a new engineering and technical department. This department pursued intensive research for new peace time uses of nickel as well as educating industry on the many attributes and benefits of using a variety of nickel alloys, including the growing auto sector.

International Nickel was created in 1901 with the merger of the Canadian Copper Company and its strategically located polymetallic nickel/copper deposits in Ontario’s Sudbury Basin – discovered in 1883 during the construction of the Canadian Pacific Railway – with the technical expertise of the U.S.-based Orford Copper Company.

American born, Stanley’s 50-year career with International Nickel began in 1901 where his metallurgical prowess was shown early on with his discovery of Monel metal, a nickel-copper alloy with high tensile strength and resistance to corrosion.

Even during the 1930s depression, nickel markets continued to expand under Stanley’s guidance but when the Second World War started, the demand for this strategic metal sky rocked. Under Stanley’s direction, the Sudbury operations – the source of roughly 90% of allied production – delivered 1 ½ billion pounds of nickel, three quarter billion pounds of copper and substantial amounts of platinum-group metals, all vital for the war effort.

The sales production numbers of nickel production tell an astonishing story of Robert Stanley’s successful career in guiding International Nickel. Under his leadership, sales of nickel increased from 13 million pounds in 1921 to 241 million in 1951, the year he passed away.

5) Dr. Norman Keevil Senior and Dr. Norman B. Keevil Junior – Teck Resources: A Canadian Mining Dynasty

Dr. Norman Keevil Senior saw the enormous potential of airborne magnetic surveys for mining exploration which helped him find a high-grade copper deposit in Ontario’s Temagami district in 1954 which began the start of the company we now know as Teck. By 1963, with his son Dr. Norman D. Keevil Junior working at the company as vice-president of exploration, at the age of 25, and a merger with four other juniors – Tech-Hughes Gold Mines, Canadian Devonian Petroleum, Lamaque Gold Mines and Howey Consolidated Mines – Teck’s amazing growth trajectory was on its way. The decision to build the Afton copper deposit in 1972 heralded the relocation of Teck’s head office to Vancouver. (Afton went into production in 1978).

In 1981, Dr. Norman B. Keevil Junior was appointed President and CEO and in 1989, Keevil Senior passed away.

A variety of coal, gold, and copper projects kept increasing the size and stature of the company but it was the acquisition of 30 per cent of the historic Canadian Pacific owned Cominco Ltd. in 1986 and the subsequent takeover of the rest of the company in 2001 – Cominco was a significantly larger miner than Teck – that made headline news in the Canadian mining scene and highlighted the financing expertise of Keevil Junior. Cominco’s assets included the largest zinc smelter in the world at Trail, B.C., a number of copper mines and the long-life Red Dog zinc mine in Alaska.

Through a series of acquisitions, mergers and green field developments, under the control of both Dr. Norm B. Keevil Senior and Dr. Norm B. Keevil Junior for much of its history, Teck is a company that encapsulates the extraordinary history and the enormous future potential of mining in this country.

The Keevils have turned Teck into the country’s largest diversified base-metal miner and with the company’s dual class share system, ensured it would safely stay in Canadian hands – a very prescient initiative in light of the takeover frenzy of the last decade which saw many venerable miners taken over by foreign buyers.

4) James Murdoch – The Father of Quebec Mining (Noranda)

Claim staked by prospector Edmond Horne and his partner Ed Miller in 1922, and backed by a New Liskeard, Ontario group of residents called the Tremoy syndicate, the very rich copper/gold deposits around Rouyn’s Osisko Lake became the basis of Noranda Inc., one Canada’s legendary mining companies.

The Tremoy syndicate was bought out by another group of wealthy investors lead by James Murdoch who would become the new company’s president for an astonishing thirty years.

Originally looking for gold in 1923, a diamond drill on the old Horne claims came up with 131 feet of sulphide deposit showing about eight per cent copper. It was the richest copper deposit up to that time in Canada. Rouyn exploded with activity and due to the gold byproduct the region became known as “Quebec’s Klondike”. Rail was built by a subsidiary of the Temiskaming and Northern Ontario Railway, whose construction started the Cobalt Silver Boom in 1903. Hollinger mine money helped finance the smelter and by 1927 the first copper was poured at Rouyn, all under Murdoch’s careful stewardship.

From the beginning Murdoch saw Noranda as a company that not only mined and refined the copper but would also fabricate products. A refinery was built in Montreal in 1930 and a rolling mill for the Canada Wire and Cable Company soon followed – all during the 1930s depression! Noranda under Murdoch became a huge complex of related metal industries.

Noranda became Canada’s second largest copper miner and produced one million ounces of gold a year by 1950. Three years before he stepped down as president in 1953 he started the development of a new copper deposit, mill and smelter in Quebec’s Gaspe and the resulting town, Murdochville, was named in his honour. He died in 1962 but is remembered as the “Father of Quebec Mining” and a committed Canadian nationalist who significantly helped build this country’s north.

3) Jules Timmins – Quebec’s Northern King of Iron Ore (Iron Ore Company of Canada/Rio Tinto)

The development of the vast iron ore deposits in the isolated wilderness of northern Quebec and Labrador by Jules Timmins is one of the greatest mining projects in Canadian history. Part of the legendary Timmins mining clan – his father Henry Timmins and uncle Noah Timmins developed the Hollinger gold mine – Jules graduated from McGill University in mining engineering and began his career as a miner at the Hollinger. He became president of Hollinger Consolidated in 1936 after the death of his uncle.

With Hollinger money, Jules purchased the mineral rights to the Ungava region in 1941 and after confirming the size of the resource established the Iron Ore Company at the end of the decade to start development. While the iron ore was of exceptional high quality and near the surface, allowing for low cost open pit mining, the infrastructure and financing challenges were great. At the same time, American steel makers in the Great Lakes basin were very concerned that their principle source of iron ore from the Mesabi Range in northern Minnesota was diminishing.

With a financing consortium of six American companies headed by Cleveland-based M.A. Hanna Company, Timmins raised the necessary capital to build a 560 kilometre railroad – the Quebec North Shore and Labrador Railway – a shipping terminal at the port at Sept-Îles on the St. Lawrence and the iron ore mine at a cost of nearly $300 million. The project was completed in 1954 and helped spur the construction of the St. Lawrence Seaway due to the need for deep-water ships to transport the iron ore directly to steel customers on the Great Lakes.

The development created tens of thousands of jobs, further development of the Labrador Iron Trough and the foundation of nearby communities of Schefferville and Labrador City. “When you think of Jules Timmins, you think of northern development and Canada’s future”, summed a leading journalist at the time – a fitting epitaph for Jules Timmins who died in Montreal on February 26, 1971.

2) Stephen B. Roman – An Empire of Uranium, Coal, Oil and Potash That Crashed (Denison Mines)

Stephen B. Roman, a Slovak immigrant who came to Canada in 1937 worked as a farmer, soldier, editor, munitions worker, speculator and investor, just to name a few occupations before he seized a great opportunity.

In 1952 the U.S. detonated its first hydrogen bomb. The then Soviet Union followed suit a year later and the nuclear arms race was in full swing. The American military desperately needed uranium and a staking rush in the Algoma district north of Blind River seemed to indicate potential deposits of this strategic mineral.

Mine engineer/prospector Arthur Stollery had staked 83 claims in the Elliot Lake camp which he sold to Roman for some $30,000 and 500,000 shares of Consolidated Denison. Those claims contained the largest uranium deposit in the world at that time and turned Stephen Roman and Denison into a major mining powerhouse. By the early 1960s, the American military canceled most of its uranium contracts and left Denison and the boom town of Elliot Lake in dire straits.

Roman diversified his company with potash mines in New Brunswick, oil and gas properties in western Canada, Spain, Greece and the development of the Quinetette coking coal project in northeastern B.C. where a new town called Tumbler Ridge was built. By the late seventies the uranium market rebounded and Denison secured a $5 billion deal – the richest mining contract ever signed – with Ontario Hydro to supply fuel for their nuclear reactors.

Stephen Roman died in 1988 and his eldest daughter Helen Roman-Barber became CEO of Denison and Roman Corporation. It was a baptism of fire. In 1989, Ontario Hydro opted out of its uranium contracts as it could buy Saskatchewan mined uranium at a much lower price. A downturn in the commodity markets brought Denison to the verge of bankruptcy. A drastic restructuring sold many of the corporation’s properties and by 1997 a much smaller Denison was a shadow of its former self.

But at his corporate peak and due to the strategic value of uranium for both military and nuclear power generation, Stephen Roman was among the most powerful business leaders in the country and his corporation played a key role in the establishment of two northern communities, Elliot Lake and Tumbler Ridge. He was a risk taker, company builder, created tremendous wealth for his shareholders, had enormous political clout and is the second most important miner in Canadian history.

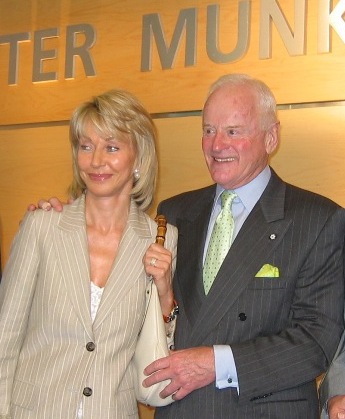

1) Peter Munk – Canada’s Godfather of Gold (Barrick Gold)

In November 2005, Peter Munk launched a takeover bid of historic Canadian gold miner Placer Dome agreeing to sell certain assets to Goldcorp. By the following spring, the takeover was complete and in less than 25 years, this upstart junior miner with two small gold operations – an Alaskan placer mine and a half interest in a small northern Ontario gold operation called Renabie – had created the largest gold mining empire in the world.

Barrick had no dual class share system like Teck to prevent a takeover – as did Goldcorp when it was launched in 1994 until 2004 – or a sympathetic Premier like Brad Wall in Saskatchewan who stopped the BHP Billiton buyout of Potash Corp. Ontario Premier McGuinty was absolutely silent when historic Ontario base-metal producers were bought by foreigners! It was a prey or predator scenario and Peter Munk came out on top.

For that reason alone, Munk deserves the top spot, as 2006 witnessed the foreign takeovers of legendary base-metal miners like Inco by Vale, Falconbridge/Noranda by Xstrata (subsequently taken over by Glencore) and Alcan swallowed by Rio Tinto in 2007. And let’s not forget the foreign takeovers of Canada’s three major steelmakers, Algoma, Dofasco and Stelco, a hollowing out of the Toronto Stock Exchange that we have yet to recover from!

Canada’s corporate elite – shell shocked at the frenzy of foreign takeovers in the middle of the last decade –could thank Munk – Hungarian born to a Jewish family – for saving at least one globally significant Canadian mining corporation that is still based in Toronto!

One of Munk’s most astute original moves was the takeover of the Camflo mine in Quebec in 1984 which came with a seasoned technical team led by mining engineer Robert Smith. This team would go on to discover the extraordinary Goldstrike deposit – one of the richest gold mines in North America – in Nevada’s Carlin Trend which really started the company’s climb to the globe’s number one gold miner.

The rapid growth of Barrick was accomplished during a period of time when the mining sector’s reputation has been in steady decline and under considerable pressure from a very media-savvy environmental movement, ensuring that mineral development faces considerably more challenges today than those faced by individuals on this list in the past – Teck’s Dr. Norman B. Kevil Junior the lone exception!

I suspect that when Noranda’s James Murdoch built a copper refinery in depression-era Montreal in 1931 or Denison’s Stephen Roman was developing his uranium mine in 1950s Elliot Lake, they were both probably heralded as economic heroes. The public perception of mining development in today’s Ontario – the much delayed Ring of Fire being a good example – or in many less developed regions of the world is much more suspect.

An offshoot of the Goldstrike discovery was the founding of a royalty company called Franco-Nevada – headed by two of Canada’s best-known mining financiers, Pierre Lassonde and Seymour Schulich – that financially benefited from the royalty rights that they bought for $2 million from the property’s previous owner. This helped turned Franco-Nevada into the world’s largest mine royalty company.

In addition, since 1992, Peter and Melanie Munk have donated more than $285 million to charities and public institutions in Canada and abroad including approximately $175 million to the Peter Munk Cardiac Centre at the University Health Network (Toronto) and about $51 million to the University of Toronto, including the establishment of the Munk School of Global Affairs.

New Generation of Mine/Company Builders

We recently passed the tenth anniversary of the takeover of companies Inco and Noranda/Falconbridge. Notwithstanding an enormous amount of national angst about a “hollowing out” of the Canadian resource sector, I want to highlight just a few individuals of the current generation of mine builders who may end up on some future Top Ten Mining People list.

Robert McEwen

Robert McEwen founded Goldcorp, with the takeover of the ageing and cash-starved Dickinson Mine in Red Lake. The controversial “out of the box thinker” is widely considered the individual who renewed that gold mining camp with his Goldcorp Challenge that put historic and then current geological data from his mine on-line and solicited the best geologists around the world to identify where to drill for new deposits.

The resulting success turned a 50,000-ounce producer in 1997 into a 500,000-ounce producer in 2001 and lowered cash costs from $360 per ounce to $60. He successfully initiated the merger of the company with Ian Telfer’s Wheaton River Minerals in 2005 and stepped down from his subsequent Chairman position by the end of that year. He went on to establish another company called McEwen Mining which has producing gold/silver mines in Argentina and Mexico as well as numerous exploration properties.

Ian Telfer

While McEwen founded Goldcorp and turned it into a mid-tier miner, it was Ian Telfer who propelled the rapidly growing company into global significance. Telfer, is a well-known mine entrepreneur who is credited with building up several multi-billion-dollar mining firms.

In 2001, he purchased a junior company, Wheaton River Minerals, with legendary financier Frank Giustra. Through an aggressive takeover strategy and taking advantage of the exploding gold price, Telfer turned an insignificant shell company into a billion dollar gold producer in just four years. In 2005, he helped engineered the $2.4-billion share swap that saw Goldcorp absorb Wheaton River.

Within the same year, in a whirlwind of M&A transactions Telfer added another 10 assets to the portfolio, merging with Glamis Gold and acquiring the Canadian assets of Placer Dome, which was being taken over by Barrick, making Goldcorp the second largest gold producer in Canada. It is currently fourth largest in the world, earning Telfer enormous respect for his financial vision.

Terry McGibbon

Terry McGibbon founded Sudbury-based FNX Mining which discovered the extraordinary rich Victoria deposit that has not yet been developed. FNX merged with Quadra Mining which in turn was taken over by KGHM, a Polish company. McGibbon also founded INV Metals which hopes to develop a gold property in Ecuador, TMAC Resources that will be opening a new gold mine in Nunavut in the next few month and guided Torex Gold’s Mexican mine through its early acquisition, exploration and development.

TMAC Resources’ Nunavut gold project is located on the Hope Bay greenstone belt – 80 kms long and 20 kms wide – which has enormous potential for further gold discoveries. Like many of the visionary mine builders previously profiled, McGibbon and his team are building and developing a brand new gold camp in the isolated far north and providing many economic opportunities for the local Inuit who are full supporting partners with this project.

Through FNX Mining, McGibbon played a key role in highlighting the continued viability of mineral discoveries in the 130-year old Sudbury Basin at a time when many thought the area was in mining decline. Sudbury continues to be the richest mining district in North America.

Sean Roosen, John Burzynski and Robert Wares

Sean Roosen, John Burzynski and Robert Wares who founded and brought into production the Canadian Malartic Mine – the largest open pit gold producer in Canada – which was taken over by Agnico-Eagle and Yamana Gold after a hostile attempt by Goldcorp. They changed the paradigm of gold mining in the Abitibi Greenstone belt by proving low grade/large tonnage open pit mining could be profitable. In less than a decade, Osisko Mining became one of the ten largest companies in Quebec.

With their new companies, Osisko Gold Royalties and Osisko Mining, the three mining entrepreneurs are consolidating properties in the Abitibi Greenstone region of Ontario and Quebec and other parts of Canada and are exploring for the next great gold deposit, focusing significant resources on the geologically unique high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau.

The legendary and extraordinarily rich Abitibi Greenstone Belt – stretching from Timmins in the east through Kirkland Lake, Rouyn-Noranda and Chibougamau in the west, is the source of Canada’s greatest gold mining camps on par with Nevada’s Carlin Trend, South Africa’s Witwatersrand Basin and the Eastern Goldfields of Australia. There is an old mining saying that roughly goes, “The best place to find a new mine is in the shadow of a headfrome!”

Sean Boyd

Agnico Eagle’s Sean Boyd who has been CEO for an astonishing 19 years – an amazing accomplishment in these volatile times – has successfully grown that company. When he became CEO in 1998, the company produced about 150,000 ounces of gold. Last year the figure was almost 1.7 million ounces and with two new Nunavut projects expected to start by the end of this decade, Agnico expects to dig 2 million ounces out of the ground by 2020 from global operations that also include Quebec, Mexico and Finland.

Their Nunavut Meadowbank gold mine has made a considerable impact on the territory’s economy. A study reported that the mine contributes about 15 per cent to the territory’s GDP and employs slightly over 300 Inuit at an average wage of $107,000 a year – the foundation of an Indigenous middle-class.

Agnico Eagle annually spends about $5 million on extensive internal skill training programs to help Inuit advance in the workforce and generates $280 million yearly in local business procurement. And royalties will be flowing to the Inuit through their umbrella organization, the Nunavut Tunngavik Inc.

Clive Johnson

In 2007, B2Gold Corp. was founded by President and CEO Clive Johnson and the former senior management of Bema Gold Corp. after that company was taken over by Kinross Gold for C$3.5 billion.

Purchasing and further expanding and developing a gold mine and previously closed gold operation in Nicaragua quickly gave the new company valuable cash flow. This allowed B2Gold to make further strategic gold mine acquisitions in the Philippines and Nambia and increase global exploration expenditures.

B2Gold has become one of the fastest growing mid-tier gold producers in the world, increasing gold production from 108,700 ounces in 2010 to between 530,000 and 570,000 ounces in 2017. Their most ambitious project to date is the Fekola gold project in Mali – West Africa’s legendary gold production was one of the major sources of the precious metal between 1000AD to 1500AD, well before the gold rushes in Australia and North and South America.

The Fekola mine is three months ahead of schedule for an October 1, 2017 start, on budget and will dramatically increase B2Gold’s production next year to between 900,000 and 950,000 ounces. The company has other deposits in neighbouring Burkina Faso as well as exploration projects in Columbia and Finland.

Robert Quartermain

Exploration geologist and mine developer Robert Quartermain has a long history of acquiring and building precious metal mines during bear markets. In 1985, he took over a small junior called Silver Standard which had a market cap of $2 million and two employees. Twenty-five years later, after an aggressive silver acquisition strategy, the company was worth around $2 billion when he resigned in 2010.

One of the companies he merged with for its silver reserves had the Brucejack project located in Golden Triangle of northwestern British Columbia, which has seen improved hydro, road and port (Stewart B.C.) infrastructure over the past decade. When Silver Standard decided to sell the asset in 2010, Quartermain formed Pretium Resources and bought the project back.

With an average grade of 14.1 grams per tonne, the Brucejack Mine – which recently made its first gold pour – is estimated to be one of the highest grade new underground projects in the world, with proven and probable reserves of 8.7 million ounces of gold and 31.9 million ounces of silver – a definite company maker. As the largest landholder with over 300,000 acres, Pretium is the largest land holder in the Golden Triangle offering enormous future potential.

Tony Makuch

Tony Makuch took over the reins at Timmin’s Lake Shore Gold in 2008 to bring a bankable gold deposit into production. Not only was he coming back to his hometown, he was also working in the richest gold camp in the country – 72 million ounces and counting. Makuch had tremendous success finding new gold reserves on the West side of Timmins, which historically had been largely ignored, and significantly increased the company’s land package for future discoveries.

Bought out in early 2016 by Tahoe Resources in an almost $1 billion deal, Makuch had built up resources of roughly 2.4 M (M&I) and 1.1M (inferred) ounces of gold at their two operating mines – and resources of about 6 million ounces of gold in all categories at their four exploration properties in the Timmins area. But most importantly, he significantly revitalized gold mining in the Timmins camp at a time when many thought it was in decline.

He is now CEO at Kirkland Lake Gold which has properties in Australia and Kirkland Lake – Canada’s second richest gold camp at 45 million ounces and counting – including the legendary Macassa mine built in 1933 which has about 2 million ounces in reserves (20.8 grams per tonne) among the richest in the country and with Makuch’s track record, the opportunity to considerably increase those reserve numbers.

Robert Friedland

Billionaire Robert Friedland’s impact on the Canadian mining sector – and his exceptional tier-1 mineral discoveries over the past 25 years – have been nothing short of astonishing.

He continues to be in mining’s international mining limelight and is a huge proponent of minerals, including copper and platinum, that need to be mined to support clean technologies and urbanization.

Discoveries by his flagship Ivanhoe Mines at its Kamoa-Kakula copper project in the Democratic Republic of Congo (DRC) have been independently verified as the largest in the history of African mining and fifth-largest in the world. Fourteen rigs still are drilling. Ivanhoe also is advancing development of its Platreef platinum discovery in South Africa and upgrading of the DRC’s Kipushi mine, whose resources of 34.9% zinc are the world’s richest.

Other high-profile discoveries by companies under his leadership include Alaska’s Fort Knox gold, bought by Kinross, Newfoundland & Labrador’s Voisey’s Bay nickel/copper project, bought by Inco for $4.3 billion, and Mongolia’s Oyu Tolgoi – one of the world’s greatest copper/gold finds that saw Rio Tinto brought in to help build the initial mine in 2006 and take majority control in 2012.

Entering Vancouver’s wild junior mining scene in 1980, he later made international headlines when the U.S. government alleged he was solely responsible for environmental conditions behind the failure of Colorado’s Summitville gold mine. A Canadian court issued an extraordinary censure of U.S. misconduct in 1996, including withholding and misrepresenting key evidence, and awarded him costs totalling $1.25 million. He later reached a voluntary settlement to help restore the mine site.

Stephen G. Roman

Stephen G. Roman was introduced to mining at the very young age of five when he went underground at the Denison Mine’s uranium operations that his father, Stephen B. Roman – one of the most powerful mining magnates during the 1950s to 1980s – was building in Elliot Lake. His sister, Helen Barber-Roman took over the company when the father died in 1988, becoming the first female CEO of a major mining company.

Stephen G. Roman has a great track record himself building the Timmins Glimmer mine in 1996 (now known as the Black Fox mine) which was sold to Apollo Gold in 2002. His next significant project was the Gold Eagle mine in the Red Lake camp. He and his partners – who the won the PDAC Bill Dennis discovery award in 2016 – sold the deposit to Goldcorp for $1.5 billion in 2008.

Harte Gold is his current junior property located just 80Kms east of the massive Hemlo deposit. Roman and his team are currently mining the deposit, building a mill and expect commercial production by mid-2018.

Currently the junior has defined roughly half a million ounces of gold and totally controls the entire, largely unexplored Dayohessarah greenstone belt. A year end updated gold estimate should considerably increase reserves while a recent Macqarie Research note estimates enormous potential.

The McLeod Mining Family

One can only marvel at the exceptional accomplishments of the multi-generational McLeod family centred around Stewart, B.C. It started with John the grandfather who immigrated from Scotland in the early 1900’s to northern B.C. and worked as a miner and prospector. Two of his sons Don and Ian stayed connected to the region. Ian worked as a miner, owned the town’s major hotel, was Stewart’s mayor for 15 years as well as a high profile advocate for mining in the north. Don started as a miner but moved into prospecting and promotion. He was integral to the discovery of four producing mines in that province.

Two of Don’s children – Bruce and Catherine – and one of Ian’s – Robert – are all accomplished mining professionals. Catherine McLeod-Seltzer is well known for her junior mining partnerships that have led to the discovery of Arequipa Resources’ rich gold deposit in Peru that was bought out by Barrick for $1.1 billion, the Peru Copper Toromocho copper deposit that was bought by Chinalco for $840 million and the co-founding of Stornoway Diamond Corporation along with her brother Bruce, which opened Quebec’s first diamond mine – just to name a few of her many accomplishments.

Her brother Bruce, a mining engineer, has previously won the E.A. Scholz award for excellence in mine development for his role in building the Minto copper-gold deposit in the Yukon. He founded Sherwood Copper which was sold to Capstone Mining for $244 million in 2008. He is currently CEO Sabina Gold and Silver and is working towards building the company’s Back River deposit which contains about 7.2 million ounces of gold in all categories located in Nunavut.

Bruce and Catherine’s cousin Robert, the youngest of the three, is a geologist. He was founder of Underworld Resources which was acquired by Kinross Gold for $140 million in 2010 for its Yukon White Gold deposit that contained a resource estimate of over 1.4 million ounces of gold. Among a variety of exploration projects he is also currently CEO of IDM Mining and is focused on developing that company’s Red Mountain project – a low cost, high grade gold deposit – located near his hometown of Stewart. And like his father, Robert is an enthusiastic proponent of the enormous mineral potential of northwestern B.C.’s Golden Triangle district.

In closing, the individuals highlighted in the “Top Ten Mining Men List” are amazing visionaries who have created enormous wealth, national economic activity, multi-generational jobs and opened up isolated and northern parts of the country. They are an integral part of our national history and we need to celebrate their amazing accomplishment especially in light of next year’s 150th anniversary celebrations of Canadian confederation.

I consulted with many people during my research for this essay, however, the four that I must acknowledge due to the generosity of their time and sage advice are David Constable, Corporate Director, Marilyn Scales, interim Editor, Canadian Mining Journal, George Werniuk, consulting geologist and Jane Werniuk, geologist at Agnico-Eagle and former editor of the Canadian Mining Journal, Canadian Mining Journal, Peter Koven, former Financial Post mining reporter and currently at Bay Street Communications, John Ing, President and CEO of Maison Placements Canada Inc. However, I take full responsibility for the final list!

Feel free to send in your comments and please indicate if they are for publication or private. And again, please remember that this is a mine builder, not a mine finder top ten list. stan.sudol@republicofmining.com

For a lengthy essay on the Top Ten Most Important Mining Events in Ontario’s history, click here: http://bit.ly/1upri55

For a historical overview of gold mining in Ontario, click here: http://bit.ly/2gVIWcq